Introduction & Need for RBI Central Bank Digital Currency

A total of 114 nations, India included, are actively considering digital currency adoption, with India already introducing its retail Central Bank Digital Currency (CBDC) on a pilot basis. The Reserve Bank of India envisions the e-Rupee, overseen and issued by the central bank, as the next-generation, seamless, widely accessible, and anonymous payment method designed to provide enhanced value to customers.

In FY 2023 (October 2023), India has registered 11,408.79 million transactions.

The evolution of technology aligns with the evolving needs of end-users, leading to an increasing number of payment use cases. Payments are integral to any financial institution, prompting central banks to explore avenues that offer innovative functionalities. Central Bank Digital Currency (CBDC) stands out as one such avenue, envisioned by the Reserve Bank of India (RBI) as the next-generation, seamless, ubiquitous, and anonymous payment mode, providing customers with enhanced value and a seamless experience.

The introduction of e-Rupee, the digital form of fiat currency regulated by the RBI, offers a viable alternative to paper currency. As the circulation of physical currency increases, it poses challenges to distribution and storage channels and has environmental implications, contributing to a carbon footprint. Moreover, increased cash circulation raises risks such as counterfeiting, spoilage, security threats, and the potential for loss or theft.

The launch of e-Rupee not only addresses these challenges but also aligns with the shift towards a digital economy. With the growing adoption of mobile and internet-based payments in India, CBDC can streamline cross-border transactions, a priority in the G20 summit. CBDC can mitigate the complexities associated with time-consuming processes and strict compliance checks in cross-border transactions, providing a more efficient and automated method for transaction and settlement. Additionally, CBDC has the potential to enhance various areas, including government securities and international forex trade.

The design of CBDC plays a crucial role, and its implications for payment systems, monetary policy, and the overall financial system depend on its intended functions. The RBI’s concept note emphasizes the importance of careful consideration in designing CBDC to ensure its positive impact on the financial landscape.

What is Digital Rupee | What is Central Bank Digital Currency CBDC

India has made significant strides in innovation in digital payments, supported by a separate law for Payment and Settlement Systems. The country now boasts state-of-the-art payment systems that are affordable, accessible, convenient, efficient, secure, and available round the clock. This transformation in payment preferences is largely due to the establishment of electronic payment systems like Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), Immediate Payment Service (IMPS), Unified Payments Interface (UPI), and mobile-based systems like Bharat Bill Payment System (BBPS) and National Electronic Toll Collection (NETC).

These developments have shifted the payments ecosystem, reducing reliance on cash and paper. The involvement of non-bank FinTech firms as Payment Instrument Issuers (PPIs), Bharat Bill Payment Operating Units (BBPOUs), and third-party application providers in the UPI platform has further accelerated the adoption of digital payments, with the Reserve Bank playing a catalytic role in promoting a safe, secure, and efficient payment system.

According to the 2018 report from CPMI-MC, there is a unique form of central bank money known as digital rupee/ money that is different from physical cash or central bank reserve or settlement accounts. This form of money has four distinct properties –

- Issuer; whether it is a central bank or not

- Form; whether it is in digital form or physical form

- Accessibility; whether it is wide or narrow

- Technology; whether it is peer-to-peer tokens or accounts

The digital rupee, or Central Bank Digital Currency (CBDC), represents a digitally native form of sovereign currency that replicates all the characteristics of physical currency. The RBI’s CBDC is strategically designed to instill structure and stability into the financial system through its multifaceted functions.

According to the Reserve Bank of India (RBI), a Central Bank Digital Currency (CBDC) is a digital manifestation of legal tender issued by the central bank. This currency holds a sovereign status and can be exchanged on a one-to-one basis with fiat currency.

Central Bank Digital Currency (CBDC) has emerged as a prominent subject of discussion in India, particularly in light of the potential introduction of the digital rupee by the Reserve Bank of India (RBI). Keyhighligts of the Digital Rupee are as follows:

- The Central Bank digital currency RBI is a sovereign currency issued by the Central Bank in accordance with monetary policy.

- CBDC represents a liability for the Central Bank.

- It is expected that Central Bank Digital Currency (CBDC) should be widely accepted as a medium of payment, legal tender, and a secure store of value by all citizens, businesses, and government entities.

- The aim is to reduce the cost of issuing money and conducting transactions.

- It is a convertible legal tender, allowing individuals (holders) to use it without the necessity of a bank account.

- CBDC can be voluntarily converted into commercial bank money and cash.

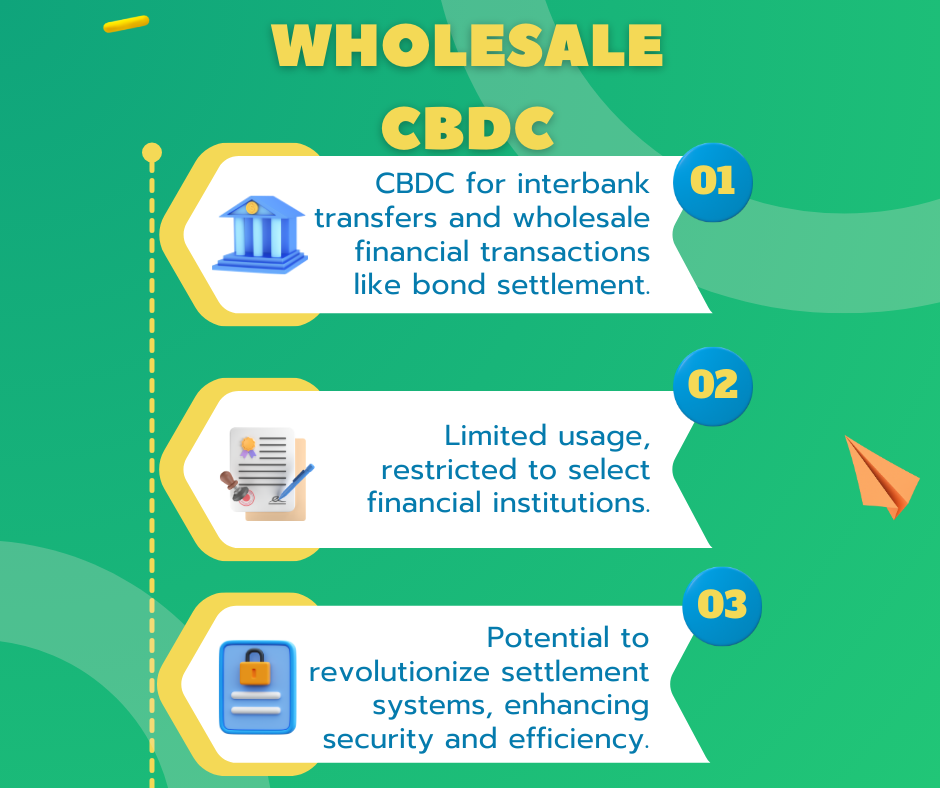

Types of CBDC or e-Rupee issued: Retail and wholesale

Role of Central Bank and Other Entities: Who administers the CBDC

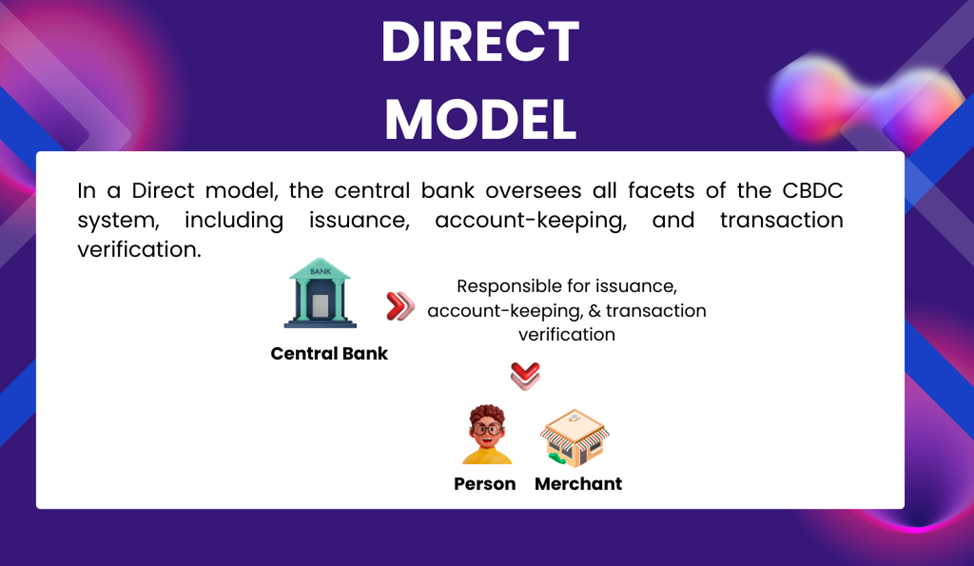

1. Single Tier Model (Direct CBDC Model):

The described model is referred to as the “Direct CBDC Model”. In this system, the central bank assumes responsibility for overseeing all aspects of the CBDC system, including issuance, account-keeping, and transaction verification. Under this model, the central bank manages the retail ledger, and its server is integral to all payment processes. The CBDC in this setup serves as a direct claim on the central bank, maintaining a comprehensive record of all balances and updating it with each transaction. This design ensures a highly resilient system, as the central bank possesses complete knowledge of retail account balances, facilitating straightforward verification and claim honoring.

However, a notable drawback of this model is its tendency to sideline private sector involvement, impeding innovation within the payment system. It is crafted for disintermediation, where the central bank directly engages with end customers. While offering disruptive potential for the current financial system, this model places an additional burden on central banks. The challenges include the direct management of customer onboarding, Know Your Customer (KYC) procedures, and Anti-Money Laundering (AML) checks, which could prove challenging and costly for the central bank.

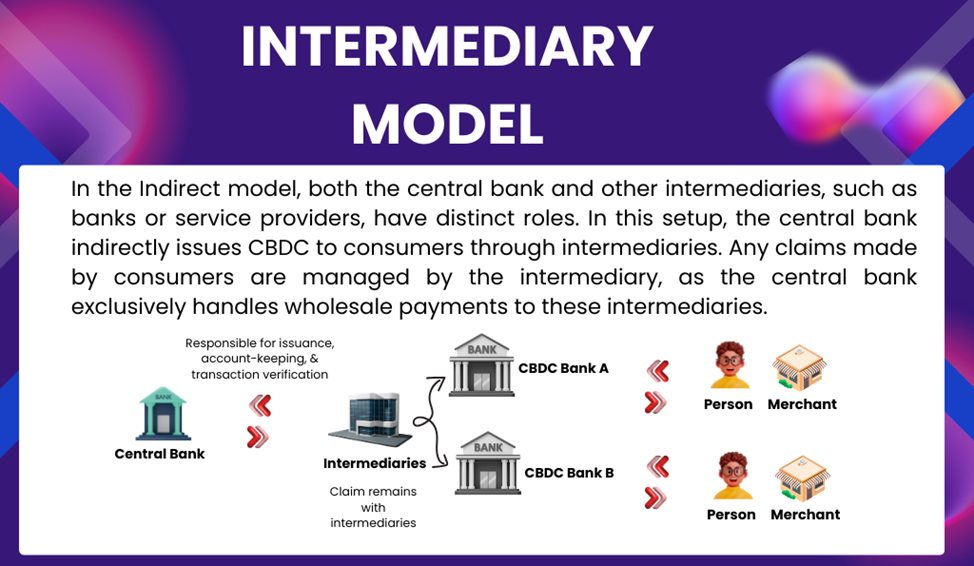

2. Two Tier Model (Intermediate model):

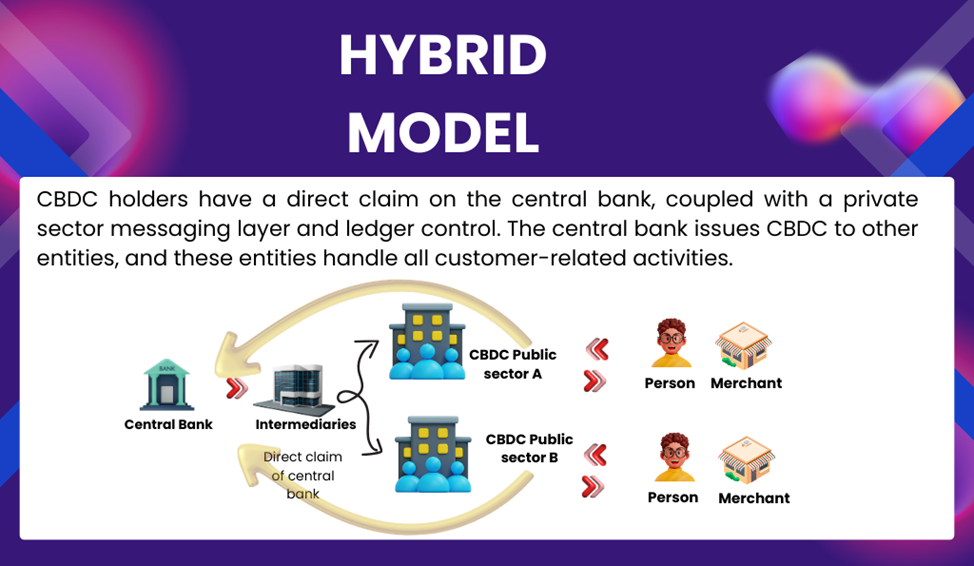

The inefficiency linked to the Single-tier model necessitates the design of CBDCs within a two-tier system, where both the central bank and other service providers have distinct roles. Within the intermediate architecture, there are two models: the Indirect Model and the Hybrid Model.

In the Indirect Model, consumers would maintain their CBDC in an account or wallet with a bank or service provider. The responsibility to provide CBDC upon demand rests with the intermediary rather than the central bank. The central bank’s role is limited to tracking the wholesale CBDC balances held by intermediaries, ensuring alignment with the total retail balances held by individual customers.

In the Hybrid model, a direct claim on the central bank is merged with a private sector messaging layer. In this arrangement, the central bank issues CBDC to other entities, making these entities responsible for all customer-associated activities. Commercial intermediaries, such as payment service providers, deliver retail services to end-users, while the central bank maintains a ledger of retail transactions.

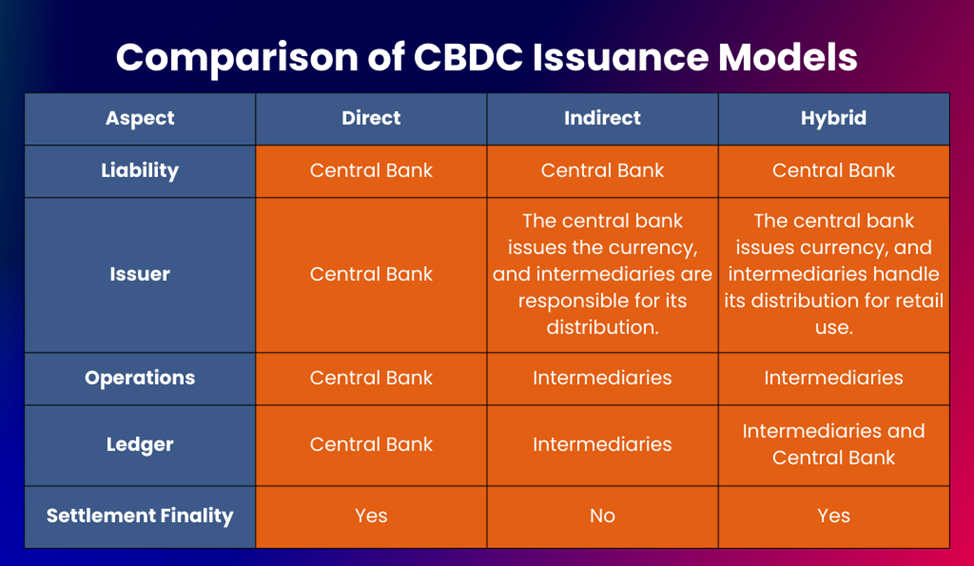

Comparison of CBDC Issuance Models

Form of design: Token based and account based

Central Bank Digital Currencies (CBDCs), being electronic representations of sovereign currency, should encompass all the essential features of physical currency. The design of CBDCs depends on the functions they are intended to fulfill, and this design has significant implications for payment systems, monetary policy, and the structure and stability of the financial system. It is crucial that the design features of CBDCs are minimally disruptive.

Key design choices when considering the issuance of CBDCs include:

- Type of CBDC: Determining whether it will be a Wholesale CBDC, a Retail CBDC, or a combination of both.

- Models for Issuance and Management: Choosing between a Direct model, an Indirect model, or a Hybrid model for issuing and overseeing CBDCs.

- Form of CBDC: Deciding whether CBDCs will be Token-based or Account-based.

- Instrument Design: Evaluating whether CBDCs should be Remunerated (earning interest) or Non-remunerated.

- Degree of Anonymity: Considering the level of anonymity or privacy that users of CBDCs should have.

These design choices are pivotal in shaping how CBDCs will operate and integrate into the existing financial landscape, and they must be made thoughtfully to ensure a smooth transition and minimize disruptions.

In the following section, we will explore the primary reasons for the introduction of India’s central bank digital currency.

Key Motivations for the Introduction of Central Bank Digital Currency India

Central Bank Digital Currencies (CBDCs) offer unique advantages as sovereign currencies, including the trust, safety, liquidity, settlement finality, and integrity associated with central bank money. In India, the exploration of CBDC issuance is motivated by various factors.

These include reducing operational costs linked to managing physical cash, promoting financial inclusion, enhancing the resilience, efficiency, and innovation of the payment system, improving settlement system efficiency, fostering innovation in cross-border payments, and providing the public with the benefits that private virtual currencies offer without the associated risks. The offline feature of CBDC can be particularly valuable in remote areas, ensuring availability and resilience in situations where electrical power or mobile networks are unavailable.

Private virtual currencies represent a departure from the traditional concept of money, as they lack intrinsic value and are not backed by commodities. The rapid proliferation of private cryptocurrencies in recent years has challenged the conventional understanding of money. These cryptocurrencies claim the advantages of decentralization and are often viewed as innovations that could disrupt the traditional financial system. However, the design of cryptocurrencies is primarily aimed at circumventing established and regulated intermediaries and control mechanisms, which play a crucial role in maintaining the integrity and stability of the monetary and financial ecosystem.

As the guardian of the monetary policy framework and with a mandate to ensure financial stability, the Reserve Bank of India has consistently highlighted the various risks associated with cryptocurrencies. These digital assets can undermine the financial and macroeconomic stability of India, with negative consequences for the financial sector. Furthermore, the widespread adoption of cryptocurrencies could diminish the ability of monetary authorities to formulate and regulate monetary policy, posing a serious challenge to the stability of the country’s financial system.

In this context, it is the central bank’s responsibility to offer its citizens a risk-free form of central bank digital money. This will provide users with the same experience as dealing in digital currency, without the associated risks of private cryptocurrencies. Therefore, CBDCs will deliver the benefits of virtual currencies to the public while ensuring consumer protection and avoiding the adverse social and economic consequences associated with private virtual currencies.

Here let’s have a look at the benefits of issuance of CBDC in detail –

The adoption of Central Bank Digital Currencies (CBDCs) is motivated by a diverse set of reasons in different jurisdictions, including:

- Popularizing Electronic Currency: In some countries like Sweden, where the usage of physical paper currency has been declining, the introduction of CBDC is seen as a way to promote a more widely accepted electronic form of currency.

- Efficiency in Cash Issuance: In nations with significant physical cash usage such as Denmark, Germany, Japan, and the United States, CBDCs are considered to streamline the issuance process, making it more efficient.

- Overcoming Geographical Barriers: In regions with geographical barriers, such as The Bahamas and the Caribbean, where islands are scattered, CBDCs can address the challenges related to the physical movement of cash.

- Addressing Private Virtual Currencies: As private virtual currencies gain popularity, central banks aim to meet the public’s demand for digital currencies while avoiding the potential negative consequences associated with these private currencies.

- Reduction in Cash Management Costs: The introduction of CBDC can lower the costs associated with managing physical cash, including expenses related to printing, storage, transportation, and replacement of banknotes.

- Promotion of Digitization: CBDC can further the government’s goal of digitization, particularly in a case like India where despite rapid digitization, cash usage continues to rise. CBDC can redirect the preference for cash transactions towards digital payments.

- Support for Competition, Efficiency, and Innovation: CBDC can enhance competition, efficiency, and innovation in the payments space, contributing to a diverse and resilient payment landscape. It provides another avenue for payments, particularly for e-commerce.

- Improvement in Cross-Border Transactions: CBDCs have the potential to improve cross-border payments by offering faster, cheaper, and more transparent cross-border transactions. It can mitigate challenges related to time zones, exchange rate differences, and regulatory requirements.

- Enhancing Financial Inclusion: CBDC can make financial services more accessible to the unbanked and underbanked populations, particularly in remote areas with limited infrastructure. It can also create digital financial records for easier access to credit.

- Safeguarding Trust in the National Currency: In the face of the proliferation of cryptocurrencies, CBDCs can provide a risk-free, sovereign digital currency, ensuring the public’s trust in the national currency. It can also protect against the potential risks and volatility associated with private virtual currencies.

Features of Central Bank Digital Currency (CBDC)

- CBDC is a sovereign currency issued by central banks to align with their monetary policy goals.

- It is recorded as a liability on the central bank’s balance sheet.

- CBDC is required to be universally accepted as a medium of payment, functioning as legal tender and a secure store of value for all citizens, businesses, and government entities.

- It must be easily exchangeable with commercial bank money and physical cash.

- CBDC is a fungible form of legal tender, allowing its use without the necessity of holding a bank account.

- The implementation of CBDC is expected to reduce the costs associated with currency issuance and transaction processing.

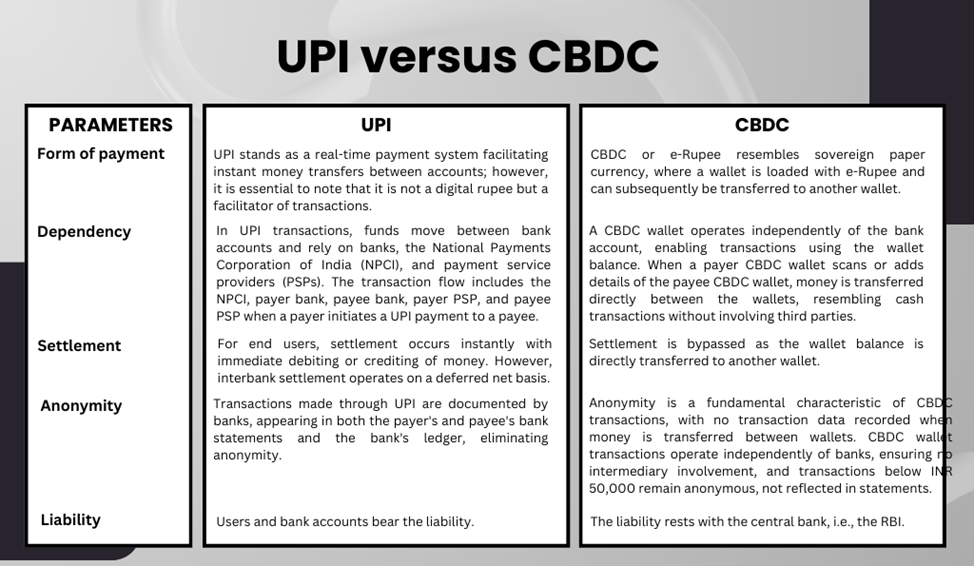

UPI versus CBDC

With the introduction of e-Rupee, there is uncertainty regarding the distinctions between UPI and CBDC. The table below clarifies these differences:

The Current worldwide situation regarding Central Bank Digital Currency (CBDC)

Over 60 central banks worldwide have shown interest in CBDC, including some that have already implemented it as either Retail or Wholesale CBDC. Others are exploring different frameworks, such as conducting research, testing, or launching CBDC.

The Bahamas, Jamaica, and Nigeria have successfully implemented CBDCs, with over 100 countries currently exploring this digital currency. Central bankers from Brazil, China, the euro area, India, and the United Kingdom are leading the way in these advancements.

17 other countries, including significant economies such as China and South Korea, are in the pilot stage and working towards launching their own central bank digital currency (CBDC). China was the first country to pilot their CBDC, known as e-CNY, in April 2022, with plans to expand its domestic use by 2023.

The increased adoption of central bank digital currency (CBDC) is viewed as a promising development and a significant advancement in the evolution of sovereign currency.

Several jurisdictions have approved the adoption of Central Bank Digital Currency (CBDC) for various reasons, some of which include –

- The Central Banks encounter a shrink in the usage of paper currency with the objective of popularizing the electronic form of currency such as in Sweden.

- The Central Banks pursue the requirement of the public with respect to digital currency to encourage the use of private virtual currencies. Hereto, evade damaging the consequences of private currencies.

- The jurisdiction with the importance of physical cash usage in order to encourage efficient issuance, in countries such as the USA, Denmark, Japan.

- The countries possessing geographical barriers that limit the physical movement of cash contains the motivation to use CBDC.

Development of Central Bank Digital Currency India

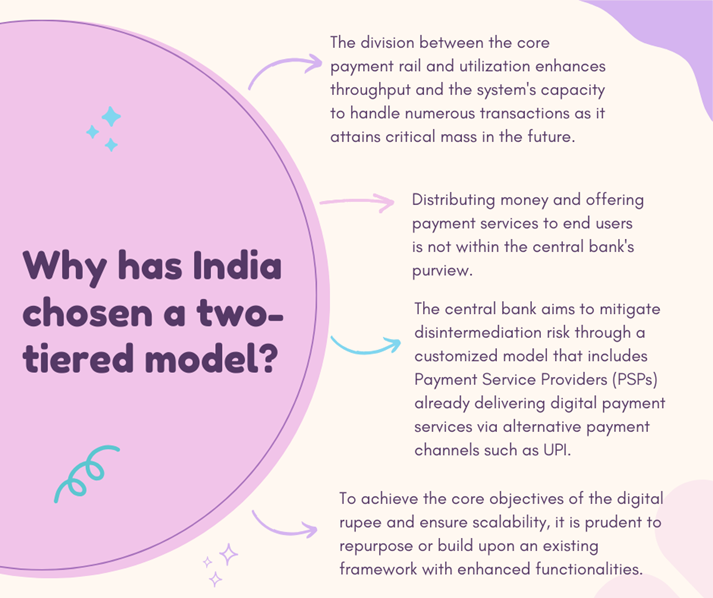

India’s CBDC architecture adopts the two-tiered model, widely used globally for CBDC implementations. In this model, banking intermediaries distribute CBDCs to the public based on the central bank’s provided MO supply. The interaction between central banks and commercial banks is facilitated by a hyperledger fabric. In the distribution tier, commercial banks and authorized intermediaries serve as nodes, transferring minted R-CBDC tokens from the central bank. The utilization and end-user interaction occur on an API-based framework, supported by an NPCI switch for routing interbank transactions.

India is one of the countries that is currently investigating the implementation of a central bank digital currency. In this blog section, we will discuss the latest updates on the digital rupee, also known as the central bank digital currency of India –

a. The First Pilot in The Digital Rupee India – Wholesale Segment (e₹-W)

The Indian government initiated the trial of the digital rupee RBI in the wholesale segment, starting on November 1st, 2022. The primary use case involves settling transactions in the secondary market for government securities. The e₹-W is expected to enhance the interbank market’s efficiency, and settling in Central Bank money will reduce transaction costs by eliminating the need for settlement guarantee infrastructure or collateral to manage settlement risks.

The RBI has selected nine banks to take part in the pilot project for Digital Rupee India wholesale –

- State Bank of India

- Union Bank of India

- Bank of Baroda

- HDFC Bank

- ICICI Bank

- IDFC First Bank

- Kotak Mahindra Bank

- HSB

- Yes Bank

Use in the Wholesale Segment:

1. Interbank Settlements:

- W-CBDC facilitates efficient interbank settlements.

- Atomic swaps enhance settlement efficiency through automation.

2. Cross-Border Transactions Improvement:

- Addresses challenges in high costs, low speed, and lack of transparency.

- Accelerates settlement processes, overcoming time zone and exchange rate issues.

3. Money Market:

- Facilitates trading in money markets like repo markets and interbank lending.

- Enhances efficiency and transparency in pricing money market instruments.

- Reduces counterparty risks and increases overall transparency.

B. Launch of First Pilot in The Digital Rupee India – Retail Segment (e₹-R)

The Reserve Bank of India (RBI) launched the first pilot of the Digital Rupee- Retail segment (e₹-R) on December 01, 2022.

The Hon’ble Minister of State for Finance Shri Pankaj Chaudhary announced that the pilot program for e₹-R is currently available in selected locations within a closed user group (CUG) consisting of participating customers and merchants. The five cities where the pilot program is available are Mumbai, New Delhi, Bengaluru, Bhubaneswar, and Chandigarh. e₹-R is a digital token that serves as legal tender, with the same denominations as paper currency and coins. It is being distributed through banks, acting as financial intermediaries. e₹-R provides the same trust, safety, and settlement finality as physical cash, but does not accrue interest and can be converted to other forms of money, such as bank deposits.

The Minister provided additional details and revealed that the RBI has picked eight banks to take part in the retail pilot project. These banks are the State Bank of India, ICICI Bank, Yes Bank, IDFC First Bank, Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank. These banks have chosen specific individuals or account holders to participate in the trials.

A new e₹ wallet had been created specifically for the pilot program. This is because e₹ is a part of the currency system, while other digital wallets belong to the payments system. Users can use the e₹-R through a digital wallet provided by participating banks, which can be accessed on mobile devices.

The Reserve Bank of India (RBI) only releases a single digital currency called Central Bank Digital Currency (CBDC) on behalf of the Indian government. This currency is a liability of the Central Bank.

The e₹-R is a digital token that represents legal tender and comes in denominations similar to paper currency and coins currently in circulation. These tokens will be distributed through intermediaries, such as banks, and users will be able to transact with e₹-R using digital wallets provided by the banks. These wallets can be stored on mobile phones or other devices.

These transactions can be of both types, that is Person to Person (P2P) and Person to Merchant (P2M), the latter (Person to Merchant) can be done through QR codes displayed at merchant locations.

Additionally, the retail industry would include the important aspects of physical currency, such as trust, safety, and the assurance of final settlement.

Use in the Retail Segment:

1. Retail Cross-Border Remittances:

- Cost reduction and increased speed and reliability.

- Especially beneficial for migrant workers sending money to families in India.

2. Microfinance:

- Supports small loans and savings through secure digital platforms.

- Embeds features like programmability, alternative underwriting models, and digital onboarding.

3. Programmability:

- Streamlines direct disbursal for widening financial inclusion.

4. Offline Payments:

- Suited for offline transactions, crucial for reaching the last layer.

- CBDCs, as tokens, enable offline payments.

Empowering Transactions: Unveiling the Future of Digital Currency with the E-rupee App

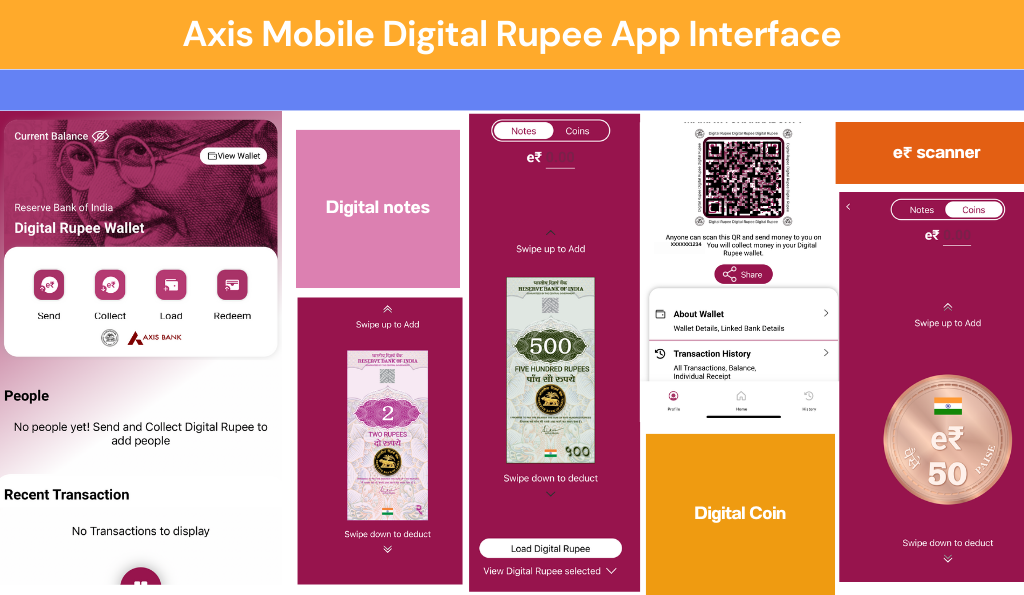

Numerous banks have embraced the digital revolution by introducing dedicated e-rupee apps, catering to the evolving needs of their customers. Among the trailblazers in this transformative journey are notable banks such as State Bank of India (SBI), ICICI Bank, Kotak Mahindra Bank, Union Bank of India (UBI), Bank of Baroda, HDFC Bank, Canara Bank, Punjab National Bank (PNB), IDFC First Bank, IndusInd Bank, Axis Bank, Yes Bank, and Federal Bank.

These forward-thinking banks have recognized the significance of providing seamless, efficient, and secure digital currency services to their customers. The e-rupee apps serve as a gateway to a wide array of financial transactions, ranging from basic fund transfers to more complex activities like online payments, investment management, and digital currency exchanges. Users can experience the convenience of managing their finances at their fingertips, with the assurance of robust security measures implemented by these trusted banking institutions.

The advent of e-rupee apps marks a pivotal shift towards a cashless and digitally-driven economy, fostering financial inclusion and enhancing the overall banking experience for customers. With features such as real-time transaction tracking, personalized financial insights, and user-friendly interfaces, these apps aim to simplify the complexities associated with traditional banking processes. The competitive landscape among these banks further fuels innovation, with each institution striving to offer unique and value-added features to stay ahead in the dynamic digital financial services sector.

As these banking giants continue to invest in technology and user-centric solutions, the e-rupee apps not only signify a commitment to staying abreast of technological advancements but also reflect a dedication to providing unparalleled convenience and accessibility to customers in an increasingly digital era. The collaborative efforts of these banks contribute significantly to reshaping the landscape of banking services, making financial interactions more efficient, transparent, and tailored to the evolving needs of the modern-day consumer.

Here we are providing visual elements showcasing the distinct elements of e-rupee services of these banks. Through these visual cues, users can gain a firsthand glimpse into the innovative features and user interfaces that these banks offer within their respective e-rupee apps.

Key considerations for increasing adoption/ usage of CBDC

1. Policy Framework:

Anonymity:

- Expectations of tiered anonymity with a transaction threshold.

- Additional KYC for transactions beyond the threshold.

Data Privacy:

- Strong, customized data privacy frameworks.

- Prioritize citizens’ best interests and limit personally identifiable information.

2. Technology:

Scaling up Central Infrastructure:

- Emphasis on modular DLT architecture for controllable decentralization.

- Focus on increasing capacity with growing transactions and throughputs.

Operational Efficiency:

- Expand operational capacity by setting distribution layer rules.

- Let ecosystem players determine on-demand computing capacity.

3. Business Case:

Viable Business Case:

- Define a viable business case, including typical and new CBDC features.

- Incorporate features like programmability and offline capabilities.

Technology Enablers:

- Open APIs play a key role in creating a level playing field.

- Help ecosystem players innovate with supervised backend access.

Services:

- Banks and non-banks build core value propositions for a CBDC portfolio.

- Key areas include access-based services, user applications, e-wallets, processing support, and technology vendors.

The rollout of CBDC or e-Rupee marks a significant step in India’s digital transformation. With the recent phasing out of the INR 2,000 banknote, CBDC could become the ideal currency for trustworthy, resilient, and efficient financial transactions. Addressing potential implementation challenges, CBDC has the potential to enhance ease of doing business by overcoming geographical barriers. As cash usage declines, CBDC can provide stability, promote financial and environmental sustainability, foster financial inclusion, and catalyze innovation.

Key Takeaways

In conclusion, the introduction of the Digital Rupee, India’s Central Bank Digital Currency (CBDC), represents a significant milestone in the evolution of money and the payment landscape. This initiative aligns with the global trend of exploring and implementing CBDCs, with over 60 central banks around the world actively considering or implementing their own digital currencies.

The Digital Rupee is designed to combine the advantages of electronic payments, including enhanced efficiency, security, and financial inclusion, with the trust and stability that central bank-backed currency provides. It aims to promote digitization, streamline cash management, and offer the benefits of digital currencies without the associated risks of private cryptocurrencies.

0 Comments