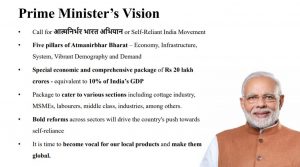

We congratulate our Hon’ble Prime Minister & Finance Minister for announcing the economic package in 5 parts to make India self-reliant (Aatmanirbhar Bharat) i.e., #AatmaNirbharBharat and for better opportunities for post-COVID-19. I am happy to share some points from my report published on 9th May 2020 on various social media platforms and where the Government was tagged, also found a place in the package like:

- Release of pending payment of MSMEs from PSUs

- Increasing the existing loan limit of the MSME sector by 20%, without any additional collateral securities

- Creation of a digital market for MSMEs

- Ease and deferment of labour law: Now, all occupations have been opened for women and permitted to work at night with safeguards. Major State Governments are now working on relaxing or deferring the labour law applicability

- The Indian Government has always been reviewing its policies in the best interest of the country. The focus should now be drawn on improving India’s performance in ease of doing business by reviewing and rationalizing its policies in Dealing with Construction Permits, Getting Electricity, Registering Property, Paying Taxes, Trading across Borders, Enforcing Contracts, Resolving Insolvency, Employing Workers and Contracting with the Government. The government has started working on ease of doing business relating to easy registration of property and fast disposal of commercial disputes for making India one of the easiest places to do business as a part of the next phase of Ease of Doing Business Reforms.

- Ease of Corporate Law and IBC laws to enhance businesses and to believe in entrepreneurs

- De-punitive and de-criminalisation of corporate and business laws:

a) lower penalties for all defaults for Small Companies, One person Companies, Producer Companies & Start-Ups.

b) decriminalization of Companies Act violations involving minor technical and procedural defaults (shortcomings in CSR reporting, inadequacies in board reports, filing defaults, delay in holding AGM).

c) majority of the compoundable offences sections are to be shifted to internal adjudication mechanism (IAM) and powers of RD for compounding enhanced (58 sections to be dealt with under IAM as compared to 18 earlier).

d) 7 compoundable offences altogether dropped and 5 to be dealt with under an alternative framework

All these will enable businesses to complete their pending compliances without payment of any additional filing fees, thereby the entrepreneurs may focus on the growth of their businesses and simultaneously de-clog the criminal courts and NCLT.

0 Comments