Has a chatbox ever asked you to open a savings account? Does ever a computerized assistant resolve your queries in minutes?

In this blog, we will understand how Artificial Intelligence drives the Indian economy.

The world of AI is tremendously booming and it can be seamlessly seen that no industry or sector has remained untouched by its prevalence. And the world of finance and banking is also among those worlds which are also anchoring the power of kick-fast change in AI.

AI is intelligence demonstrated through machines, as opposed to natural intelligence present in humans and animals. It contains streamlined programs and procedures, including its ability to perform automated routine tasks, improve customer service, and assist businesses in achieving success, not only in the financial sector, but also in other sectors such as telecommunications, manufacturing, and more.

Therefore, taking the economy on the path of automation.

Undoubtedly, Artificial Intelligence has been evolving in India since 1950s, from the neonatal stage, when the idea of AI culture had coined to a complete boom state, where AI was intensively being used to store large data, VRs, ARs, and IoTs – India is taking every possible initiative to embed AI in every nook and corner of society.

India’s National Strategy for AI has been prepared by NITI Ayog (a premier policy think tank of the Indian Government through providing directional and policy inputs) to harness the power of AI in distinct fields. AI’s practical and effort approach can adequately address societal needs in distinct aspects of healthcare, agriculture, education, smart cities, infrastructure, smart mobility and transportation.

With the advent of the 21st century, due to its incredible advances in data processing, collection, and computation power, electronics has become ubiquitous in almost every sector, be it the manufacturing or the service sector. Further, AI is now deployed in distinct tasks and decision-making to allow better connectivity and productivity.

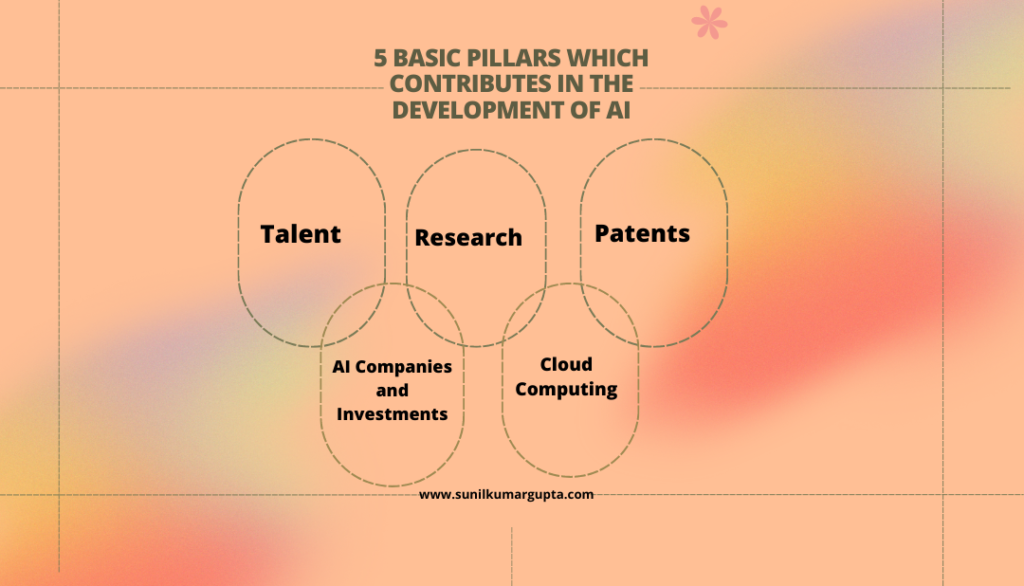

Basic Pillars Which Contribute To The Development of AI

- Talent

Talent is the strongest pipeline for India to be successful and no doubt, India does have the resources for the same. Since India has the largest youth population in the world (around 66% of the population), and with the Indian government’s emphasis on continual training of a high-skilled workforce, India can soon become an AI hub.

Moreover, India produces twice as many master-level engineering graduates as the United States, which provides it a competitive edge over other countries. And India is moving in the right direction through the introduction of initiatives like AI for Youth (commenced in 2020) to make the youth ready for future AI developments.

Taking this initiative forward, “Responsible AI For Youth 2022” was created by the National E-governance Division, Ministry of Electronics and Information Technology, Government of India in collaboration with Intel. It is launched by the Ministry of Electronics and IT.

- Research

India has the largest AI research community in the world and since 2010, it stands 4th in the largest producer of AI-relevant scholarly papers. It provides an edge to India’s youth population to increase their outreach, especially with their counterparts in the United States.

A two-tier integrated approach is introduced to magnify the core and applied research in AI –

- Centers of Research Excellence in Artificial Intelligence (CORES), it will emphasize on the core research of AI.

- International Center for Transformational Artificial Intelligence (ICTAI), this tier will help in establishing an ecosystem for the application based technological development and deployment.

- Patents

Since 2012, India ranks in the 10th position in the top 10 AI patent-producing countries, due to the immense increase in AI-driven inventions. Moreover, personal devices and computing, business, telecommunications, including life science are the four largest categories for AI patents in India.

Collectively, these are associated with over 70% of India’s AI patents and reflect that Indian innovators have emphasized on applying AI to traditional strengths. In the past two decades, India has come a long way in AI patenting, since, the benefit of using patents to protect their devices is reflected.

- AI Companies and Investments

More than 50% of Indian companies applying AI to their products are active in business analytics, medicine, finance, sales, retail, and customer relations.

NASSCOM has predicted that by FY 2026, industrial and automotive, healthcare, retail and CPG and BFSI will contribute 60% of possible AI-driven value to India. Moreover, AI companies and investments are continually bouncing back, considering that private companies’ investment in India has witnessed steady growth from 2015 to 2019.

- Cloud Computing

India is using market cloud computing as a proxy for AI chips to support its AI computing needs since it does not have the domestic manufacturing capacity to manufacture AI chips. Also, India is lagging behind in cloud computing, yet contemporary, cloud bared markets are growing because of the rising demand for computing power.

Be it talent, research, patents, investment in AI, or cloud computing – India has been moving in the right direction utilizing its population strength by introducing varied initiatives to promote AI in distinct fields.

In addition to that, the government has introduced “AIRAWAT” (AI Research, Analytics, And Knowledge Assimilation Platform) which is a cloud platform for big data analytics and assimilation, with the power-optimized AI computing infrastructure using advanced AI processing.

Apart from that, the Indian government has been investing in other schemes such as Digital India with the purpose to boost AI, IoT, big data, and robotics, including providing subsidies to startups under “Start-up India.”

From the given information, we can easily understand that the Indian government has been working on all aspects to make AI a reality in India, from establishing institutes to providing cloud support and AI research. This in return, is contributing to business growth through financial inclusions since, due to the development of AI in the financial services and sector, students can easily access the loan facility for education, training, or even to establish their business.

How AI is Helping The Financial Services | Contribution of AI in Financial Services To Boost Indian Economy | AI in Financial Services

The field of Artificial Intelligence has enormously evolved since the introduction of revolutionary techniques and algorithms using automated tools. This revolutionized growth of AI in financial services and sectors has significantly been an impetus for the Indian economy.

The majority of banks and financial institutions use and recognize the true benefits of Artificial Intelligence. They are using it to respond to their customers at a faster pace around the clock. Not only does AI help provide a better customer experience, but it also frees up the personnel, improves the security measures of the institutions, and ensures that they are moving in the right direction when it comes to technology.

Here are some of the ways Artificial Intelligence is helping in the financial services and sectors:

1. Risk Assessment and Management

Till now, fintech, banks, and other financial institutions were using human resources to assess and manage their risks. Whether it was loan eligibility checking, trading, or banking, human resources were the way to go.

But with the implementation of AI, these tasks have now become much easier to perform. With the advancement of data sciences and machine learning algorithms, Artificial Intelligence is becoming even smarter in risk assessment and management for financial institutions.

2. Process Automation

One of the best things about an AI is that it can do the same thing again and again without getting tired, in other words – automation. With the help of AI, financial institutions can automate repetitive and mundane tasks with ease and efficiency. This allows valuable human resources to focus on the other important tasks and projects.

3. Reducing Human Error

Humans tend to make mistakes regardless of how experienced or gifted they are. According to recent studies, more than 90% of cloud breaches and financial frauds are caused by human errors. There have been several cases where the loss of valuable data, capital, and resources has been caused by minor human errors.

With the implementation of artificial intelligence, these errors have dropped drastically. In other words, AI reduces human errors and saves valuable data and resources while preventing cyberattacks and frauds.

4. Better Customer Interaction

Virtual assistants (VAs) and chatbots can do what regular human resources can not, they can be available for customers 24/7 and offer relevant solutions. Thanks to the implementation of Artificial Intelligence, chatbots and VAs have become even smarter in their workings.

Of course, the customers of any financial institution still need human interaction to solve difficult problems. Still, thanks to the help of AI, virtual assistants can respond to customer’s needs with minimal effort.

5. Cyberattack and Fraud Detection and Prevention

Any financial institution, whether it is banks, insurance companies, or brokerage firms, they are always in danger of fraud and cyberattack. And it’s not just the business houses themselves, it’s also their customers who are prone to cyber crimes.

However, thanks to the implementation of AI, fraud, and cyberattacks are detected and prevented regularly keeping both the financial institution and its customer safe.

6. Compliance

AI can successfully streamline compliance alert systems to near-perfection, considering that it is built to learn from compliance officers’ data, especially in today’s data-driven compliance environment, AI technology is tremendously improving the efficiency of compliance operations by lowering expenses.

One of the best examples of “how AI helps in ensuring compliance” could be its usage in IT solutions to address the problem of wasting time and money every day.

Apart from that, Artificial Intelligence successfully automates the workflow, therefore, minimum time and human resources are necessary to support compliance operations. In addition to that, AI minimizes the possibility of human error which could occur due to the availability of a sheer volume of data.

7. Financial Inclusion

With AI and data analytics, financial products are seamlessly available to a large part of the population, even those with no formal bank account, payslip, or digital financial track record.

The access to small financial loans have now become feasible, since the entire process is automated and scalable. In addition to that, fintech companies have found a pathway to monetize the regulatory stumbling blocks which have kept traditional banks from lending money to the poor. With the introduction of AI, the idea of money lending has taken a new shape that’s “data available on customer’s mobile.” Therefore, creating a mobile digital credit score, a reality, which was once a dream.

Financial inclusion has established a new pathway, where a needy person can easily obtain a loan from the banks and financial institutions, thus pushing Indian youth on the path of “entrepreneurship” rather than seeking jobs. Therefore, fulfilling one more agenda of the Indian government that’s “employment generation.”

Such development has marked the emergence of new business models, with traditional banks parenting with fintech to provide digital credit score services, including the emergence of non-bank fintech in a digital lending space.

Apart from that, the use of AI is tremendously increasing to screen loans and select financial product sale recommendations. This is done based on historical data, therefore, eliminating the possibility of prejudice.

Benefiting youth with easy access to loans, AI has become a tool for maximizing the access of financial services to farmers using data and machine learning (major components of AI) algorithms to eliminate the possibility of fraud and allow seamless access of funds to credit-worthy farmers.

That can allow the government to limit farmers’ suicide in India, since easy access to loans and credit facilities will resolve farmers’ problems by ensuring direct access to equipment for irrigation, fertilizers, etc. Therefore, it will result in better cultivation and profit.

AI not only resolves credit and funds-associated issues for farmers, youth, or entrepreneurs, but it also provides financial services/ assistance to startups, MSMEs, and emerging tech companies.

With the introduction of AI, financial inclusion has become a reality, where everyone has access to financial services since it facilitates branchless banking that not only minimizes the cost of banking but also makes financial services accessible.

From AI-based chatbots resolving your query 24*7 to communicate through messaging apps, including educating customers about their financial health, AI has taken over the world.

India is the fastest growing economy with a significant contribution to the development of AI, considering that India has the finest AI research concentrated institutes such as IITs, IIITs, and IISc.

And let’s not forget, that India is home to a highly skilled workforce, which matches the distinct technological market and a large start-up ecosystem that adds to over 77,000 DPIIT-recognized startups accessing 655 districts of the country as of August 2022.

Realizing the potential, the Indian government is also taking the necessary initiatives to steer the country and position it among the top leaders in AI.

Moreover, as per a recent study, AI is estimated to boost India’s annual growth rate by 1.3% by 2035 and has the potential to add 1 trillion to the Indian economy in 2035.

From this data, we can conclude that AI plays an important role in the development of the Indian economy as a whole.

However, with tremendous growth, AI also brings “privacy and data protection issues” which are far from only one. Concerns range from threats to privacy to threats to human dignity and safety.

Artificial Intelligence – Issues

Artificial Intelligence is developing at a fast pace and it seems like it could grow so immensely that it would be challenging for humans to control it. Moreover, AI systems developed by humans are working in every possible intelligence they could, now humans are themselves threatened by its development.

- Threat to Privacy

An AI program recognizes speech, understands natural language, and is capable of understanding every conversation via emails and telephone calls. Therefore, the amount of data stored in AI models could impose the risk of data security and privacy violations.

Proposed Solution –

- The usage of “state of art encrypted methods” can be used to ensure data security and privacy violations.

- The use of “low encrypted cloud software” must be avoided.

- Threat to Human Dignity

AI has replaced humans in many industries, however, there is no doubt that in the near future, it will replace humans working in dignified positions such as nurses, surgeons, etc. Therefore, the functions performed by AI systems are a substitute for us (humans) that devalues and deteriorates human flourishing.

Proposed Solution –

- Despite massive improvements in AI technology, any minor fault can impose major risk, especially in the case of the use of AI in hospitals. Therefore, the presence of a doctor is essential to avoid such situations.

- Software engineers or developers should come up with a hybrid model, where AI technology could assist doctors/ surgeons/ or other practitioners, rather than completely taking over the work. This will prevent the devaluation of human flourishing.

- Threat to Safety

AI systems are self-improving and advanced, which can become so mighty in comparison to humans that it could be challenging to prevent them from achieving their goals, which can result in unintentional consequences.

Therefore, AI applications, which are in direct contact with humans or are integrated into the human body, impose safety risks, since they can be misused and hacked.

Artificial intelligence is certainly a blessing, only if used for the right purpose and to minimize interference in human lives.

Proposed Solution –

- Strong and unique passwords and two-factor authentication must be used to prevent hacking.

- Search engines must be blocked from tracking.

- Evict the unused applications and extensions.

- Online browsing must be done through a secure VPN.

Conclusion

“India is all set to be an AI hub, with the right acquisition of talent (youth), research, patents, AI companies, investment, and cloud computing.”

From the introduction of metaverse to bitcoins/ cryptocurrency, indeed the world is on a rollercoaster ride of growth and development.

AI can change the financial services and sector completely, by allowing intelligent automation, labor and capital augmentation, and innovation diffusion which will help in ensuring technical feasibility, availability of structured data, regulatory barriers, and other benefits. Maybe someday, AI would be advanced enough to improve human relationships and resolve ethical issues.

India has emerged as the 3rd largest startup ecosystem globally, containing over 77,000 DPIIT-recognized startups across 656 districts of India as of 29th August 2022. As of September 2022, India had a total of 107 unicorns accounting for a valuation of $340.79 billion. The Indian unicorns (a term used to describe a privately owned startup company with a valuation of over $1 billion) are flourishing in a fast manner since these startups are not only developing or proposing innovative solutions and advanced technologies but are also contributing to the employment generation at a large scale.

Moreover, researchers have seen that AI has the potential to add 1 trillion dollars to the Indian economy in 2035. However, this is not the only factor responsible for economic growth. To know more on what are the factors that will lead to a $30 trillion economy, read it on our upcoming blog.

Something to think about!

Written & Compiled by CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

0 Comments