by Sunil Kumar Gupta | Mar 26, 2020 | blog

Relaxation from tax and regulatory compliance timelines in view of COVID-19 outbreak

Having gripped the world with massive footprints, the coronavirus pandemic has kicked off a wave of mass hysteria over the conscious precautions. Surging cases of people hoarding essential commodities in large quantities, have come to the notice. Routine life of everyone is badly affected due to shutting down of schools, colleges, malls, Cinema halls etc. India has gone in lockdown mode and economy will also remain in this mode with the increasing cases of the spread of Covid-19 disease at a fast clip over the past few days. Several companies such as Maruti Suzuki India Ltd, Titan Co. Ltd, Dabur India Ltd and Asian Paints Ltd. have announced closure of their manufacturing facilities. All domestic passenger flights are being suspended for the month.

While there is a general agreement that social distancing is the need of the hour, there are growing concerns over the severe economic impact of an extreme lockdown situation. India has gone ahead of various countries in imposing strict restrictions on its citizens to fight the spread of Covid-19.

In this situation the India Government decided to defer the Tax and regulatory payments and compliance filings as a relief to combat the existing crisis. The Hon’ble Finance Minister (FM), Nirmala Sitharaman held a press conference on Tuesday 24th March, 2020 to announce various important relief measures taken by the government on statutory and regulatory compliance matters which has been highlighted below:

a) Income Tax

- Due date for filing belated and revised income tax returns (ITR) under section 139(4) and 139(5) respectively of the Income Tax Act, for FY 2018-19 (AY 2019-20), extended from 31st March, 2020 to 30th June, 2020.

- A person having Permanent Account Number (PAN) is required to link his Aadhaar number on or before 31st March, 2020. Failure to do so shall make the PAN inoperative immediately after 31st March, 2020. Extension has been granted for linking of Aadhaar with PAN from 31st March 2020 to 30th June 2020.

- Under the Direct Tax Vivad se Vishwas Act, 2020, if a taxpayer under the Act opts for withdrawal of appeals, he/she is required to pay 100 % of the disputed tax if paid by 31st March, 2020, and if paid after 31st March, 2020, 110 % of the disputed tax is required to be paid. Under the relief measures announced in the press release, the additional 10 % amount has been waived off, if the amount is paid by 30th June, 2020.

- It has been now decided that where the time limit of due dates for issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents and time limit for completion of proceedings by the authority and any compliance by the taxpayer, including investment in saving instruments or investments for roll over benefit of capital gains under Income Tax Act, Wealth Tax Act, Prohibition of Benami Property Transaction Act, Black Money Act, STT law, CTT law, Equalisation Levy law, Vivad Se Vishwas law is expiring between 20th March, 2020 to 29th June, 2020, it shall be extended to 30th June, 2020.

- In the cases of delay in deposit of advance tax, self-assessment tax, regular tax, TCS, equalisation levy, Securities Transaction Tax (STT), Commodities Transaction Tax (CTT), interest of 12% p.a. (i.e. 1% p.m.) and for delay in deposit of TDS interest of 18% p.a. (i.e. 1.5% p.m.) is levied. The Government has given a relief by reducing the interest rate of 9% p.a. (i.e. 0.75% p.m.) instead of 12%/18% and removing the penalty provision, only in the cases where delayed payments will be made during 20th March, 2020 to 30th June, 2020.

b) GST/Indirect Tax

- Taxpayers having aggregate annual turnover less than INR 5 crore will be allowed to file return under Form GSTR-3B due in March 2020, April 2020 and May 2020, till 30th June, 2020 without any interest, late fee, and penalty whereas others having annual turnover more than or equals to INR 5 crore will be allowed to file the same with a reduced interest of 9% p.a. instead of the existing 18% p.a., from 15 days after the relevant due date but without any late fee or penalty.

- Another major relief provided is the extension of the due date for opting for composition scheme till 30th June, 2020. Moreover, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for FY 2019-20 by the composition dealers has also be extended till the 30th June, 2020.

- The due date of filing the annual return in Form GSTR-9 for the FY 2018-19, which was due on 31st March, 2020, has been extended till 30th June, 2020. (Notification no. 15/2020 – Central Tax dated 23 March 2020 has already been issued in relation to the extension of due date for filing annual return for FY 2018-19).

- Due dates for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where is expiring between 20th March, 2020 to 29th June, 2020, has been proposed to be extended to 30th June, 2020.

- Moreover payment date under Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 shall be extended to 30th June, 2020 without any interest, if payment is made by 30th June, 2020.

c) Customs

The Government has decided to start customs clearance on 24X7 basis till 30th June, 2020, even during the lockdown period and has also decided to relax the timelines where due date for issuance of notice, notification, approval order, sanction order, filing of appeal, furnishing applications, reports, any other documents etc. or time limit for any compliance under the Customs Act and other allied laws is expiring between 20th March, 2020 to 29th June 2020, it has been decided to extend the same till 30th June, 2020.

d) Financial Services

Considering the crisis situation and the lockdown decision, the government has decided that no charges will be levied on cash withdrawal through Debit Card from any other bank’s ATM, no fees will be charged for not maintaining the minimum balance requirement and there will be a reduction in the bank charges for digital trade transactions for all trade finance consumers for the next 3 months.

e) Corporate Affairs

- In order to reduce the financial burden from the non-compliant Companies/ LLPs and to clear their backlog of pending filings and to make a ‘fresh start’ the Government has decided to waive the additional fees for delay in filing of any form, document, return, statement etc. with MCA, during the moratorium period starting from 1st April, 2020 to 30th September, 2020.

- It has also been decided to extend the mandatory time gap between two Board meetings as per the Companies Act, 2013 (currently 120 days) has be extended by 60 days for quarter ending 30th June, 2020 and 30th September, 2020.

- The Hon’ble Finance Minister even highlighted that the applicability of the recently introduced Companies (Auditor’s Report) Order, 2020 shall be made from FY 2020-2021 instead of FY 2019-2020 s as to ease the burden from the Companies as well as the Auditors.

- A major relaxation provided by the Government is the removal of the condition of non-compliance with the provisions of Schedule IV of the Companies Act, 2013 in case of inability of holding separate meeting of Independent Directors during the FY 2019-2020.

- Timelines for creation of deposit reserve of 20% of the deposits maturing during FY 2020-2021 has been relaxed from 30th April, 2020 till 30th June, 2020.

- Requirement to invest 15 % of debentures maturing during a particular year in specified instruments before 30th April, 2020, has been extended to 30th June, 2020.

- As per the provisions of the Companies (Amendment) Ordinance 2018, a newly incorporated company needs to file a declaration for Commencement of Business (in Form INC-20A) with the Registrar of Companies within 180 days of the date of incorporation of the company. An additional time period of 6 months has now been allowed to the newly incorporated companies.

- Inability to meet minimum residency requirement of stay in India for 182 days by at least one director of the company under section 149 of the Act, shall not be treated as a violation for FY 2019-20.

- In order to prevent triggering of insolvency proceedings against MSMEs, the thresholds of default under section 4 of Insolvency and Bankruptcy Code, 2016 (IBC, 2016) has been raised to INR 1 crore (from the existing threshold of INR 1 lakh). It has been declared that in case the COVID-19 outbreak continues beyond 30th April, 2020, the government may consider suspending section 7, 9 and 10 of the IBC 2016 for a period of 6 months to stop companies at large from being forced into insolvency proceedings in such force majeure causes of default.

Detailed notifications/circulars regarding any/all the above compliance requirements shall be reviewed and issued by the Ministry of Corporate Affairs as and when required.

Conclusion:

It is not only the statutory and compliance relaxation, but it has also been discussed and decided that in order to normalise the entire scenario, import of SPF Shrimp Broodstock and other Agriculture inputs expiring between 1st March, 2020 to 15th April, 2020 has been extended by 3 months, delay upto 1 month in arrival of consignments shall be condoned. There will be no additional rebooking charges for quarantine cubicles for cancelled consignments in Aquatic Quarantine Facility (AQF) Chennai and the verification of documents and grant of NOC for Quarantine has been relaxed from 7 days to 3 days.

In order to combat the impact of coronavirus on the economy and to mitigate the aftereffects of Covid-19, the Government is now working out on the Economic packages. The Hon’ble Finance Minister of India stated that every attention is being given to the economy and the Hon’ble Price Minister is also closely monitoring the situation. The current situation in the economy may not improve immediately but the entire global economy may take some time to grow and attain the desired level.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com

by Sunil Kumar Gupta | Mar 17, 2020 | blog

MCA has notified new Companies (Auditor’s Report) Order, 2020 (hereafter referred to as CARO, 2020) on February 25, 2020 replacing the previous Companies (Auditor’s Report) Order, 2016. CARO and is applicable from immediate effect. As per CARO 2020, Auditor has to highlight the qualification in the report in Italics. CARO will be annexed to the main Audit Report in which an Auditor gives assurance of the compliances of the Accounting Standard and Companies Act made.

CARO, 2020 is divided into four sections viz. New Clauses, Re-instatement from old CARO versions, deletion of Clauses and brief Comparison with CARO, 2016.

1. NEW CLAUSES

1.1. Fixed Assets – Immovable Properties [Clause 3(i)]

1.1-1. Disclose immovable properties whose title is not held by the company [Clause 3(i)(c)]

CARO 2020 requires disclosure of land and building and other immovable properties which are recognised as fixed assets but the title of such assets is not with the body corporate. In case immovable properties exist but in the Co’s name, then disclosure is required regarding Property description with ownership title ( Name and relation with the company executives), range of period for which property is held and the amount capitalised, the rationale for not holding the property in the name of the company. MCA has suggested the following format in this case:

| Description of property |

Gross carrying value |

Held in name of |

Whether promoter, director or their relative or employee |

Period held – indicate range, where appropriate |

Reason for not being held in name of company * |

| – |

– |

– |

– |

– |

*also indicate if in dispute |

One of the rationales is that accounting provisions apply only in case the title of the asset is held in the name of the company. Another rationale for such disclosure is to protect the interest of the lenders as Loans given by lenders to entities are based upon certain ratios which are dependent upon the amount of fixed assets recognised in the financial statements. With this disclosure, lenders would be in a better position to take a decision for financing the company when the title does not belong to the company.

1.1-2. Disclose revaluation for fixed assets or intangible assets happened during the year[Clause 3(i)(d)]

The company has to disclose if it’s Property, Plant and Equipment (including Right of Use assets) or intangible assets or both have been revalued during the year :

a) Whether the revaluation is based on the valuation by a Registered Valuer

b) Specify the amount of change, if change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment or intangible assets

Ind AS10 allows companies to follow either the cost model or the revaluation model. In case a company follows a revaluation model then a revaluation surplus is recognised in the balance sheet as a revaluation surplus. Further changes in the revalued amount are recognised in revaluation surplus or statement of profit and loss depending upon certain conditions and Auditors are required to highlight this upfront in the CARO report.

1.1-3. Disclosure required for Benami Transactions [Clause 3(i)(e)]

CARO 2020 requires disclosure for transactions even if proceedings are initiated (even if not complete) OR proceedings are pending against a company for holding any benami property. Since audit firms are required to sign the audit report, Auditors shall now be more stringent about the application of Benami Transactions (Prohibition) Act, 1988 (45 of 1988) and rules made thereunder.

Now management as well audit firms cannot take the shield of materiality and probability and have to provide notes to accounts in financial statements. Even if a transaction is not material, CARO requires disclosure in financial statements for proceedings regarding benami transactions in notes to accounts.

1.2. Working capital loan above Rs 5 crore – Auditors to tally returns or statements filed with banks with accounting books [Clause 3(ii)(b)]

Companies file a lot of accounting data (past information and projected statements) to banks and financial institutions to obtain working capital limits. The lender, on the other hand, is concerned about the accuracy of such data filed. The government has now stipulated that if the sanctioned limit(s), by combining limits of all banks/ FIs (Present/Proposed), exceed Rs 5 crores, then auditors are required to certify that quarterly results or the statements filed by the company with the banks are in line with the accounting books.

Considering the above provisions, auditors shall now be doing a pre-audit whenever the management is obtaining a new working capital loan or increasing their existing limits. Although CARO shall be filed by the end of the financial year the auditors shall insist upon management to get approval.

1.3. Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties [Clause 3(iii)]

MCA intends to tighten the disclosures regarding repayment and realization of loans and advances given by entities.

It needs to be checked whether during the year the company has made investments in, provided any guarantee or security or granted any loans or advances in the nature of loans, secured or unsecured, to companies, firms, LLPs or any other parties. If yes, indicate aggregate amount during the year,

– to subsidiaries, joint ventures and associates;

– to parties other than subsidiaries, joint ventures and associates;

- whether the investments made, guarantees provided, security given and the terms and conditions are not prejudicial to the company’s interest;

- whether the schedule of repayment of principal and payment of interest has been stipulated and whether the repayments or receipts are regular;

- if the amount is overdue, state the total amount overdue for more than 90 days, and if reasonable steps have been taken by the company for recovery of the principal and interest;

- whether any loan or advance granted which has fallen due, has been renewed or extended or fresh loans granted to settle the overdues of existing loans given to the same parties, if so, specify the aggregate amount of such dues renewed or extended or settled by fresh loans and the percentage of the aggregate to the total loans or advances

- whether the company has granted any loans or advances in the nature of loans either repayable on demand or without specifying any terms or period of repayment, if so, specify the aggregate amount, percentage thereof to the total loans granted, aggregate amount of loans granted to Promoters, related parties as defined in clause (76) of section 2 of the Companies Act, 2013;

The focus of CARO 2020 is more towards highlighting any non-repayment or non-compliance by any errant party. From an accounting perspective [no change in accounting], any default in loans and advances made are accounted for by making a provision against the unrecoverable amount in the financial statements.

An auditor is required to report the aggregate amount and balance outstanding; whether the terms are prejudicial or not; whether the repayment plan has been specified and the repayment is in accordance with the terms agreed; the amount overdue; any extension or renewal of the amount fallen due during the period; and whether any loan or advance is granted to promoters or related parties without specifying repayment terms.

1.4. Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts[Clause 3(viii)]

1.4.1. Case A: Income was properly recognised in books of accounts but the income tax was not offered correctly. In case a company properly recorded income but while calculating income tax, income was not included or incorrect amount was included for assessing income tax and such income was offered to tax during the income tax assessments then auditors are required to consider such income. Proper accounting is to be ensured or to report in CARO disclosure.

1.4.2. Case B: Income was offered during income tax assessment and such income was not correctly recorded as per accounting provisions.

In case a company surrendered or offered income during income tax assessment and such income was either not recorded at all or recorded at incorrect amount or recorded in incorrect accounting period as per the accounting provisions then auditor needs to Treat such income as per the provisions of AS 5 and to report such income in CARO.

1.5. Default in repayment of loans or other borrowings or in the payment of interest [Clause 3(ix)(a)]

CARO 2016 specified the default on repayment of principal of financial institution, bank, Government or dues to debenture holders and CARO 2020 covers all the lenders and specifies the following format of disclosure:

| Nature of borrowing, including debt securities |

Name of lender* |

Amount not paid on due date |

Whether principal or interest |

No. of days delay or unpaid |

Remarks, if any |

| *lender wise details to be provided in case of defaults to banks, financial institutions and Government. |

1.6. Wilful defaulter [Clause 3(ix)(b)]

A wilful defaulter is defined as a company/ individual that has an ability to repay the loan but fails to do so. In case, a company defaults in repayments of loans, other borrowings or interest then the company is required to make such disclosure in the CARO report. Further, in case an entity has been disclosed as wilful defaulter by any financial institution (including banks) then auditor needs to highlight such fact in the CARO 2020 report.

This provision is introduced in view of the fact that number of wilful defaulters in nationalised banks have increased by over 60 per cent during the last five years.

1.7. Reporting of Whistle-blower complaints[Clause 3(xi)(c)]

This is one of the key steps introduced for marching towards corporate whistleblowers as at present, the Whistleblower Protection Act, 2014 is not applicable to corporates, government bodies, projects and offices.

CARO 2020 requires an auditor to report whistle-blower complaints received against the company.

1.8. Utilization of short-term funds for long-term purposes [Clause 3(ix)(d)]

CARO 2020 has even highlighted the requirement of disclosing the nature and amount of funds raised on short term basis and which has been utilised for long term purposes. This clause would protect the company and the stakeholders from the misutilisation of funds of the company and resulting in reduction of the defaults in repayment.

1.9. Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures [Clause 3(ix)(e)]

Another important addition in the recent CARO is if the company has taken any funds from any entity or person on account of or to meet the obligations of its subsidiaries, associates or joint ventures, it needs to disclose the details and nature along with the amount of transactions.

1.10. Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies [Clause 3(ix)(f)]

Now the Auditors need to specify in their report if the company has raised loans during the year on the pledge of securities held in its subsidiaries, joint ventures or associate companies, along with the details thereof and also report if the company has defaulted in repayment of such loans raised.

1.11. Fraud by and on the company [Clause 3(xi)(a)]

CARO 2020 has widened the scope of earlier Clause 3(x) of the CARO 2019 by deleting the words ‘by its officers or employees’ from the disclosure requirements in case any fraud by the company or any fraud on the company has been noticed or reported during the year. The auditors need to record the nature and the amount involved in the transaction.

1.12. Report under sub-section (12) of section 143 of the Companies Act, 2013 [Clause 3(xi)(b)]

The auditors need to record whether any report under sub-section (12) of section 143 of the Companies Act has been filed by the auditors in Form ADT-4 as prescribed under rule 13 of Companies (Audit and Auditors) Rules, 2014 with the Central Government.

1.13. Default in payment of interest on deposits or repayment [Clause 3(xii)(c)]

MCA has inserted this additional reporting requirement in case there is any default in payment of interest on deposits or repayment thereof for any period by the Company.

1.14. Internal Audit [Clause 3(xiv)]

An Auditor need to report if the company has an internal audit system commensurate with the size and nature of its business and if the reports of the Internal Auditors for the period under audit were considered by the statutory auditor.

This clause has been inserted to systemise the audit procedure and effectively implement the same in the Company.

1.15. Carrying on NBFC Business or becoming a Core Investment company[Clause 3(xvi)]

Core investment companies (CIC) are NBFCs holding at least 90% of their net assets in the form of investment in equity shares, preference shares, debt or loans, debentures, bonds in group companies. CARO 2020 requires an auditor to check whether an entity which is carrying on NBFC business, housing finance activities without a valid Certificate of Registration from Reserve Bank of India (RBI) or does a CIC fulfil the criteria of a CIC, and in case the company is an exempted or unregistered CIC, whether it continues to fulfil such criteria. If there are a group of CICs, then the auditor is required to provide number of CIC companies under that group.

The main rationale behind this disclosure requirement in CARO 2020 is because large CIC companies have recently defaulted.

1.16. Cash losses [Clause 3(xvii)]

An auditor now will have to report if the company has incurred cash losses in the financial year and in the immediately preceding financial year along with the amount of loss incurred.

1.17 Resignation of Statutory auditors [Clause 3(xviii)]

Presently, section 139 of the Companies Act, 2013 prescribes various compliances with respect to an auditor resignation. The new CARO requires disclosure by the new auditor in case a statutory auditor has resigned with the reasons and the issues raised by the previous auditor. If the reasons behind the resignation is something like hiding of material information by management, code of ethics is being violated or involvement of entity in accounting scandals then in such cases, it becomes important for the new auditor to communicate with outgoing auditor to consider the facts before deciding to accept the audit assignment.

Practically, this requirement is fulfilled by sending a courtesy letter by the new auditor to the previous auditor regarding their appointment seeking any objection or issue the previous auditor wants to highlight.

1.18 Uncertainty in repayment of Liabilities [Clause 3(xix]

Disclosure required in this clause would enable the auditor to determine whether an entity is financially stable. This clause is more about assessing the validity of fundamental accounting assumption of going concern in accordance with Standards on Auditing (Revised) 570 and then respond to the CARO clause.

CARO 2020 requires a specific certification that no material uncertainty exists in a company to pay its liabilities within a period of one year from the due date. This new clause has increased the auditor’s responsibility to determine and disclose the financial health of an entity to meet its liabilities existing in the balance sheet.

1.19 Unspent amount on Corporate Social Responsibility (CSR) expenditure [Clause 3(xx)]

Section 135 of the Companies Act, 2013 requires certain class of companies to spend 2% of their average net profits of past 3 years in pursuance of its Corporate Social Responsibility Policy.

Any amount remaining unspent on CSR activities (except due to some ongoing projects) shall be transferred within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank in the name of “ Unspent Corporate Social Responsibility Account”, and such amount shall be spent by the company in pursuance of its obligation towards the CSR Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII of the Companies Act, 2013, within a period of thirty days from the date of completion of the third financial year.

In case the company contravenes such provision, then there are penal provisions in the Act and disclosure of any unspent amount is to be reported by the auditor in CARO report.

1.20 CARO for Consolidated Financial Statements [Clause 3(xxi)]

In case of multiple subsidiaries, joint ventures and associates, it is possible that one audit firm may take all the audits of group entities or various audit firms may be involved for the audit of the entire group. CARO 2020 requires that in case respective auditors have made any qualifications or adverse remarks then the following disclosure should be made:

a) Details of such companies [Name and relationship – Subsidiaries, Joint venture and Associates]

b) Clause no. of respective CARO report of such companies containing such qualifications and adverse remarks.

CARO 2020 recognises the fact that there can be few matters which should be addressed via CARO report for consolidated financial statements.

2. REINSTATEMENT OF CLAUSES FROM PREVIOUS CARO VERSIONS

Following clauses have been re-instated from previous CARO versions:

a) Cash losses incurred [Clause 3(xvii)]

b) Internal audit system [Clause 3(xiv)]

3. DELETION OF CLAUSE FROM CARO, 2016

The clause Managerial remuneration [Clause 3(xi))] has been deleted from CARO, 2016.

4. BRIEF COMPARISON OF CARO, 2020 WITH CARO, 2016

The previous CARO did not cover the records showing full particulars of intangible assets and was not applicable to disclosures on Fixed Assets – Immovable Properties, Working capital loan above Rs 5 crore where auditors need to tally returns or statements filed with banks with accounting books, Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties, Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts, Default in repayment of loans or other borrowings or in the payment of interest, Wilful defaulter, Reporting of Whistle-blower complaints, Utilization of short-term funds for long-term purposes, Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures, Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies, Report under sub-section (12) of section 143 of the Companies Act, 2013, Default in payment of interest on deposits or repayment, Internal Audit system, Carrying on NBFC Business or becoming a Core Investment company, Cash losses, Resignation of Statutory auditors, Uncertainty in repayment of Liabilities, Unspent amount on Corporate Social Responsibility (CSR) expenditure and CARO for Consolidated Financial Statements which have now been made part of CARO 2020 and altered the reporting requirements in case of any Fraud by and on the company in the current CARO.

Conclusion

CARO 2020 is one of the Government’s major initiatives with the primary objective of necessitating greater transparency by fortifying corporate governance under the Companies Act, 2013 as applicable for the audit of financial statements of eligible companies. Earlier it was applicable for the financial years commencing on or after the 1st April 2019 but keeping in view the massive effect of Covid19 and the recent lockdown, the Government has decided to make it effective for the next Financial Year i.e. FY 2020-21.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

www.sarcassociates.com

by Sunil Kumar Gupta | May 14, 2019 | blog

The numerous claims and counterclaims on employment numbers make for a dangerous and fascinating read. Thanks to the politicization of employment numbers in anticipation of the upcoming general elections, we are now being overwhelmed with figures from all directions. However, all the studies suffer from majorly serious drawbacks. It’s truly the case of blind men and the elephant.

In July 2018, honorable Prime Minister stated in the Parliament that if both formal and informal sectors were to be considered, then nearly 10 million jobs had been generated in a year.

These new employment numbers were stitched from the Employee Provident Fund and the National Pension Scheme. The number of new professionals joining the system, like chartered accountants and doctors, were also considered to calculate formal employment numbers. However, if employment were rising, then it would have been reflected in higher consumption and savings; but this was not the case. Further, the number of youths migrating from rural to urban areas has hit a roadblock as the real estate market faced stagnation last year due to RERA.

However, the survey conducted by the Centre for Monitoring Indian Economy (CMIE) presents a counterclaim to the 10 million number.

In the absence of timely, publicly released and survey-based employment data from the government, the CMIE gained currency. This private organisation, which maintains economic and business databases, conducts a four-monthly unemployment survey with a sample size of over 178,000 households. This survey indicates that in the year 2018, the number of employed people had shrunk by nearly 10 million. It had shrunk down from 406 million in December 2017 to 396 million in December 2018. The unemployment rate has been estimated at 7.23% in February 2019 as opposed to 5.87% a year ago.

This is not much in contradiction to the leaked NSSO report, which stated that the unemployment rate is 6.1%. This report suggested that unemployment is at a “45 years high”. The 2015-16 Labour Bureau’s Employment Unemployment Survey put such rate at 5%. The Azim Premji University’s State of Working India 2018 puts the unemployment rate at over 5%, with youth unemployment being thrice the overall rate.

At the other end of the spectrum, the unemployment rate reported by the Census 2011 is as high as 11.8%. Yes, that’s correct. The Census put employment numbers at 482.88 million of “main” and “marginal” workers, with unemployment numbers being put at 60.7 million. And we know that there is no data more comprehensive than the ones reported by the Census, where surveyors literally knock on each door to collect information.

So, why are economic data, especially employment numbers, so profusely contradictory and unreliable? How can such data be made more credible?

Conducting surveys in India has always been a tricky affair, with the ever growing population and small changes bringing about unexpected results. But there are specific ways that the government of India, as well as the private sector, can resort to making job data more credible.

Firstly, the NSC needs to be reconstituted and empowered with adequate resources at the earliest for it to function as an independent watchdog. The statistical agencies require strengthening with improved timeliness and accuracy. It has also become necessary to enhance the human resources of these agencies and revamp its internal infrastructure to adapt to the changing data needs and procedures.

Secondly, both CMIE and NSSO suffer from a significantly huge drawback: they base their reports on data collected over months. This implies that they won’t be able to publish their reports at a particular point of time. For instance, if a person is unemployed in January and finds a job in March, they would still be categorized as unemployed by these agencies. The only effective way to report accurate data is by completing the survey in a day – or within a week at best. This, in turn, implies the need for a greater man force and only the government will be able to achieve this. Besides, the CMIE and other sources of data are essential in keeping the government data honest.

Thirdly, the methodology needs to be improved. Under the current methodology, it takes a lot of time and effort to collect data from a small sample size. In rural areas, the number of households surveyed was 55,000 as opposed to 160 million households in the country. Such small sample sizes result in higher data sensitivity. Responses can be facilitated from a higher number of households in a quick span of time through the use of technology.

In the context of the ongoing debate on India’s employment numbers, efforts are immediately needed to improve the availability of quality data in order to resolve narrative driven debate through objective evidence. Such a collection and transmission of quality data by robust institutions is imperative for the development of a strong policy framework.

by Sunil Kumar Gupta | May 8, 2019 | blog

- Introduction

Unless you’ve been sleeping on our national economy for the past few years or so, you’ll definitely know that the Indian textile industry has been a resounding turnaround story. Importance of Textile Industry is known to almost everybody, In fact only industry besides agriculture to have provided skilled and unskilled labor to a substantial population. It employs employs 5.1 cr people directly and over 7 Cr indirectly and indirectly. Even today, it still stands tall as the 2nd largest employment providing sector in India.

Some Economic Data Points Regarding Textile Industry

- During FY 2018, Indian Textile exports were at US$ 39.2 bn in FY18 and they are projected to increase to US$ 82.00 bn by 2021.

- Indian textiles industry is currently at US$ 150 bn and is projected to reach US$ 250 bn by 2019.

- India’s textiles industry contributes 2% to Indian GDP.

- India’s textiles industry employed more than 45 mn people in FY18.

- India’s textiles industry contributed 15% to export earnings of India in 2017-18.

- Existence of end to end value chain within the country — finished goods, fabrics, yarns and fibre.

- Indian Textile Industry – A historical perspective

When putting into perspective the various struggles the textile industry had to face in a country like India, one cannot ignore the vast evolution of it. To understand this turnaround story we will have to go back to prehistoric era. You should not be surprised when we say that India has been a textile-savvy country since the dawn of Harappan civilization. Archaeological experts have found that citizens of the Harappan civilization were aware of cotton spinning and weaving techniques even then. This is four thousand years ago! References of this awareness were found in Vedic literature which is factually seen as relevant for various instances in Indian history. Textile trade too was found in India during the early centuries. This took place when remains of a particular fabric which originated in the state of Gujarat, was found in Egypt. The finding itself is proof of India’s textile trade back then. Large swathes of India’s reputed silk were transported to China through the silk route thousands of years ago. The genesis of the colonial era, marked the beginning of slowdown and eventual decline of the textile industry. But it soon saw its uprising once again during the nineteenth century. Soon, the country’s first textile mill was established in the year 1818 in Calcutta. With this, began the modern era of textiles in India. By the end of the second half of the century, there was an approximate total of 178 mills established. The industry took a massive hit when it was hit by the great famine which led to a lot of big mils to be closed down.

- Indian Textile Industry – SWOT Analysis

In order to take a “deep dive” into the world of the Indian textile industry, we must first acknowledge its strengths and weaknesses. Like any industry of the world that has existed to date, the textile industry has a lot of strengths that have contributed to the country’s economic value. However, in the same way, it also has a lot of weaknesses that should be addressed.

Strengths

- A growing domestic market to look forward to.

- Prominent position in the value chain.

- Skilled labor at low-cost value.

- Availability of raw material in local market.

Weaknesses

- Outdated technology

- Low levels of productivity in comparison to other countries and industries

- Lack of access to infrastructure, capital and power

- Fragmented Nature of Industry

- Disconnect between the cotton growing areas and the areas where cotton is processed into cloth

Opportunities

- High labor costs abroad

- Unlimited market access

- Growing domestic market

- Increased adoption of standardized products

Threats

- Inflexibility on interest rates

- Abrupt rise of labor wages

- Emergence of markets like Bangladesh and Vietnam which are huge threats

- Absence of protections under WTO

- Implementation of global compliance standards like OHSAS – 18000, SA – 8000 and ISO – 14000 standard which will be a lag on competitiveness of Industry

The textile sector comprises 80 per cent of Ministry of Micro, Small and Medium Enterprises (MSME) players. They need flexible labor laws and a skilled workforce as the sector itself lacked the structural know how to bring about these initiatives, themselves. Let us focus on the bright side of things first. Probably the most appreciated aspect of the industry is the number of raw materials it has. This might not seem like a huge deal at first, but the abundance of raw materials actually the industry to breathe and not put too much pressure on costs. It helps control it within the sector. Skilled labor also faces fewer costs. India’s textile industry also stands steady in the value chain as a sector itself. Compared to various other textile-driven neighboring countries such as Bangladesh and Sri Lanka, who have been introduced as ‘garment countries’, India has a prominent position. The industry also has a growing domestic market which lessens the risks involved and increases the competitive aspect. While all these elements are considered good and give the textile industry a chance to shine, it has faced tons of challenges and has risen to the top after several attempts. India’s textile world is extremely fragmented. As mentioned above, it is divided among sectors and is dominated by the existing unorganized sector as well as other small industries. What is the influence of a fragmented industry? Well, for instance, it denies the possibility to expand on a global scale.

- Factors behind revival of Textile Industry Post-2005, the industry seemed to have faced the most struggles. There were some opportunities that needed to be put into consideration. The challenge was to make India focus more on product development. This also meant more specialized fabrics being brought in, using CAD to increase the design capacity of the industry, and an increase in trend focus so as to enable proper growth in the future. The revival story can be directly attributed to a slew of government reforms like.

- Improved Access to Credit

- Tax Incentives

- Labor Reforms

- Improved Access to Power

- Access to New Market Geographies

-

- Improved Access to Credit – Rs 1300 cr disbursed as part of Samarth Scheme and Rs 6000 were allocated as a downstream package. This coupled with state wide incentives and increase of import duties on textile was a big positive for Textile Industry

- Tax Incentives – A tax scheme to give rebates on state and central taxes that effectively made exports of textile commodities zero-rated.

- Labor Reforms – Under Pradhan Mantri Rojgar Protsahan Yojana as of January 2019, 1,24 lacs establishments have availed this scheme where 12% contribution to EPF is made by Government and it provides a sense of social security to labor associated with textile industry and formalization of labor force as well.

- Improved Access To Power – Ministry of Textiles along with Ministry of Power launched SAATHI scheme to improve access of power loom units. Under this scheme, EESL will procure energy efficient power looms, kits and motor equipment which will be provided to Small Power loom units at zero upfront cost. This will not only improve efficiency in this industry but also improve energy savings and thus reduce operational costs. It is expected that these savings will pay for cost incurred by EESL within 5 years.

- Access to New Market Geographies – As part of ‘Look East’ doctrine, new markets geographies in Korea, Japan were identified. Integrated Market plans for these geographies were set in motion.

About the Author

Sunil Kumar Gupta is an entrepreneur par excellence, philanthropist and a great visionary. He is the Leader of Indo European Business Forum (IEBF) and also the Founder Chairman of SARC & Associates, Chartered Accountants and SARC Foundation and Life Trustee of Rashtriya Antyodaya Sangh, a Public Charitable Trust. He has over 32 years of experience in diverse fields such as Corporate planning, Financing, Taxation, Banking, Education, Investments, Oil & Gas and in project implementations. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI), Life Member of Indian Council of Arbitration and Full Member of the Institute of Certified Public Accountants of Uganda (CPA-U).

by Sunil Kumar Gupta | May 6, 2019 | blog

It would not be an understatement to say that in the last few years, Angel Tax has had a huge impact on the start-up ecosystem! Over the past year, there have been reports of several early-stage start-ups receiving notices from the income tax department asking them to clear outstanding dues on the angel funding received by them. This has caused a big distress in the start-up community. Many angels have been asked to pay upwards of 30% of their total funding as angel tax. They have also received many notices from the Income Tax department prompting them to furnish details of the source of their income and also their bank account statements.

So what exactly is the angel tax?

It is the tax levied on an Angel investor who invests in a start-up based on capital gains. It is calculated as the differential between their investment and fair market valuation. Now that’s where the problem lies, how do you determine the fair market valuation of start-ups?

Angel investors are generally ultra-high-net-worth individuals or professional investors who fund start-ups for gaining stakes in the start-up generally at the foundation stage or after bootstrapping rounds. The tax was introduced by former finance minister Pranab Mukherjee in the 2012 Union Budget to prevent the laundering of funds. Since its introduction, the law has been a big source of worry for both the start-up community and angel investors.

Impact of Angel Tax:

- Limitations on Angel Investor’s autonomy in structuring funding contours & terms

Since its introduction, the Angel Tax has majorly disrupted the market dynamics since its introduction. Since the funding is now based on the criteria and limits set by the government, it becomes challenging for investors to finance start-ups as it takes away their autonomy in structuring deals.

- Taxation structure that reduces the IRR for Angel Investors

In India, the government treats angel investment as an equity investment and capital gains are applicable. In Indian law, Income tax is not imposed on capital but on profit actually, this is a big burden on the start-up ecosystem. When an angel investor invests in a start-up they are issued shares. The change in the price of these shares over time decides the quantum of capital gains. Angel investors and start-ups have long demanded that Discounted Cash flow method be applied to valuation to calculate angel tax viz a viz Net Asset Value. The government feels that the commercial negotiation between start-up and investor to determine a start-up’s projected earnings is highly subjective and susceptible to money laundering.

- Impact on the flow of funds to the rapidly flourishing Startup Ecosystem

The introduction of the Angel tax has had a devastating impact on the country’s start-up ecosystem which was just starting to bloom around the year 2011-12. It should be noted that the number of companies being funded through angel investors had dropped by 80% during the same period, also angel funding has reportedly faced a drop of over 55%.

- Start-up Migration to other countries

Angle tax has pushed start-ups to shift their businesses to alternate destinations overseas. As some countries in the APAC region provide a more friendly and conducive taxation and funding environment for start-ups to get them up and running, most also have policies to support the sales of their products and services. This is in stark contrast to the current environment for start-ups in India which has led to substantial loss of income and limitation of their opportunities to raise capital due to incessant and stringent tax laws.

Recent Amendments and Developments:

Off late there have been some relaxations for start-ups, as you know earlier, for a start-up to gain the status of start-up they should have been incorporated or registered in a period of seven years, but that period has now been increased to ten years. Their turnover limit has been increased to hundred crores from 25 crores, and not only that this new notification has done away with section 56(2) of the IT Act which restricted investment into the start-up to the fair market value of the start-ups. Remember earlier the investments coming into a start-up would have to be less than the fair market value of the startup and this was a point of concern for start-ups as the criteria for evaluation was not clear so now that has been relaxed and any amount of money irrespective of the fair market value is now exempted from the tax. Other major developments have also been mentioned below

- For recognized startups requirement of ‘Merchant Banker Valuation’ has now been done away with.

- Approval of the Inter-Ministerial Board is no longer required for claiming exemption u/s 56 (2) (viib)

- Department of Industrial Policy and Promotion will send applications from startups for shares that have already been issued or for a proposed investment. that are seeking exemptions to the Central Board of Direct Taxes (CBDT) for approval which has to be provided or rejected within 45 days from receipt of the application by CBDT.

Notable challenges:

- The notification maintains complete silence when it comes to addressing the entities regarding assessment orders that have been passed already. This leads to a demand rise as a result of the Angel Tax. Obtaining instant recognition as a startup from the government and defending the case at the appellate stage seems to be the sole option for such companies.

- Bar on using Angel fund investments received for one entity, so if you got an investment for one entity you cannot use it in another entity whether it’s a subsidiary, group, or holding of the same entity. The government’s prime motive was to prevent the diversion of funds and the generation of black money through complex entities. This bar has led to a sense of restlessness among start-ups.

- Pending notification from CBDT and IT department regarding changes in IT laws to make this notification more credible and enforceable.

About the Author

Sunil Kumar Gupta is an entrepreneur par excellence, philanthropist, and a great visionary. He is the Leader of Indo European Business Forum (IEBF) and also the Founder Chairman of SARC & Associates, Chartered Accountants, and SARC Foundation, and Life Trustee of Rashtriya Antyodaya Sangh, a Public Charitable Trust. He has over 32 years of experience in diverse fields such as Corporate planning, Financing, Taxation, Banking, Education, Investments, Oil & Gas, and project implementations. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI), a Life Member of the Indian Council of Arbitration, and a Full Member of the Institute of Certified Public Accountants of Uganda (CPA-U).

by Sunil Kumar Gupta | May 6, 2019 | blog

What is Pradhan Mantri Awas Yojana and how it is going to change the face of the nation?

If you notice, even with such a big nation like India, in the last 60-70 years not everyone has a house of their own. We’ve also been noticing from the past few years that every person wants to have his/her own house. However, it’s only after they spend time between the ages of 25-40 working a job or a business that they manage to think about buying their own house.

Today, the statistics of the country show that about 40-45% population of our country is earning a monthly income of about ₹10,000 – 25,000. So someone with a gain of 10,000 – 25,000 cannot even think about buying their own house and those who have a higher income even if they buy a house, it takes them 20-25 years to make their house, so they cannot actually enjoy living in their property in their prime years.

So how do we solve that? How do we make sure that every citizen in the country has their own property? Considering that vision, our esteemed prime minister – I always say he has a really good vision, made a unique plan. The statistics of our country say that the requirement of a house is 96% for LIG & EWS which means smaller affordable housing. But in our country, whether it was a government agency or private builders, they would try to earn super-normal profits, and to do that they kept making such properties suitable for the super-rich, who could buy them for their investments. The person who had 1 house s/he bought 2 more, 3 more, and then sold them at a higher price. This way the person continued doing his/her business but the common man who earned about Rs 25,000 – 40,000 was left out and just kept wondering if they’d ever be able to afford a house of their own or not. So to fulfill that, this Yojna was made which made affordable housing possible.

So the government announced that by 2022, they aim at making about 3 crore properties in the countryside (Gramin Shetra) and 2 crore houses in the cities. They wanted to make a total of 5 crore houses due to which every person, every household i.e., a person and his/her family should at least have a house of their own. That is why this Yojna was brought into action.

About the Author

Sunil Kumar Gupta is an entrepreneur par excellence, philanthropist, and a great visionary. He is the Leader of Indo European Business Forum (IEBF) and also the Founder Chairman of SARC & Associates, Chartered Accountants, and SARC Foundation, and Life Trustee of Rashtriya Antyodaya Sangh, a Public Charitable Trust. He has over 32 years of experience in diverse fields such as Corporate planning, Financing, Taxation, Banking, Education, Investments, Oil & Gas, and project implementations. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI), a Life Member of the Indian Council of Arbitration, and a Full Member of the Institute of Certified Public Accountants of Uganda (CPA-U).

Due to his business acumen, and analytical & policy-making skills, Mr. Gupta has been a part of several international delegations. He accompanied the Former Hon’ble President of India Mrs. Pratibha Devi Singh Patil in the business delegation to Seychelles and South Africa, to discuss bilateral issues between the two nations. He was also a part of the 21-member delegation from the Institute of Chartered Accountants of India to Vienna, Austria in 2011.

Mr. Gupta is associated with various Government Authorities, as a Consultant for Income Tax and GST matters, like Northern Railways (NR), Delhi Development Authority, DGH (Ministry of Petroleum and Natural Gas, Govt. of India), New Okhla Industrial Development Authority (NOIDA), Greater Noida Industrial Development Authority (GNIDA), Yamuna Expressway Industrial Development Authority (YEIDA).

by Sunil Kumar Gupta | May 6, 2019 | blog

The link between a nations foreign policy and economic development is well known. With the advent of digital technologies the world has become increasingly interconnected and any change is nations foreign policy is quickly transmitted and impacts many key economic indicators like trade deficit, FDI flows and more. India’s Act East Policy has been a major focus of current government , it not only reflects the growing role of East Asia as a bloc in new economic order but is also very important for India from a trade standpoint. So the Act East policy is a reflection of internal circumstances and a rapidly fluid external environment. India has renamed its Look East policy to Act East Policy [AEP] which is a glowing recognition that India’s economic agenda has now shifted eastwards to as high as 50% now. The core driver of this shift are nations like Japan, China, Bangladesh and the ASEAN block. ASEAN has a history of trading more with the rest of the worlds than within the region. ASEAN accounts for a combined population of 1.9 Billion which is close to 25% of global population and combined GDP is estimated to be close to US $ 4 Trillion. There are sub-regional initiatives like BBIN (Bangladesh, Bhutan, India and Nepal) within the ambit of AEP as well for example the electricity grid of Bangladesh Bangladesh, Nepal and Bhutan are now connected with India and they already have Power Purchase Agreements with India’s National Power Grid. Work has already started on 45 Km railway link between Agartala in Tripura and Akhaura in Chittagong in Bangladesh. Other than that there are major economic investments underway which have been summarized below

- Trilateral Highway Project

Trilateral Highway proposal aims to link India, Myanmar and Thailand and is part of an overarching multi sector economic initiative of (BIMSTEC), an international organization comprising of Bangladesh, India, Myanmar, Sri Lanka, Thailand and Bhutan. The project will boost economic relationship between India and ASEAN. This project will connect Moreh in Mainpur to Mae Sot in Thailand via Myanmar. There will be 2 border crossings, four customer checkpoints and three customs Electronic Data Interchange systems which will usher in a new era of trade prosperity of India. According to many empirical studies the states in North East Region which would be part of this corridor will witness an increase of 35% over other states through which this corridor does not pass by 2040

- BCIM Economic Corridor

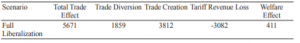

This economic corridor has been proposed between Bangladesh, China, India and Myanmar (BCIM) and will involve multi-modal connectivity to promote trade and investment. It would run between Kolkata (India) to Kunming (China) and pass through Bangladesh and Myanmar. According to a study it can have a positive total trade effect spillover of 5671 Mn dollars.

Source : Md. Tariqur Rahman and Muhammad Al Amin, “Prospects of Economic Cooperation in the Bangladesh, China, India and Myanmar Region: A Quantitative Assessment,”

There are countless other initiatives as well which are part of the India’s act east policy towards especially through Japan which have been India’s long standing counter to China. India is one of the largest beneficiary of Japanese official development assistance loans since 2003 and has been one of the largest recipients of Japanese official development assistance (ODA) loans and has been an official partner of choice be it investments in India’s much fabled Bullet Train project, Japanese Auto clusters in India’s Gurgaon-Manesar-Neemrana Belt, DMIC corridor among others as well.

Conclusion

India’s Act-East policy today is one of the best strategized policy by Indian government. It is being largely on economic rationale to integrate India’s economy with rapidly expanding East Asian economies. It has expanded its focus to not only ASEAN but also to far east economies like Japan and South Korea. This will also help us counter the trade deficit India have with China which is a major trade concern. Incorporation of North East Region by establishing commerce and connectivity projects also have the potential to double GDP of these states in coming five years.

About the Author

Sunil Kumar Gupta is an entrepreneur par excellence, philanthropist and a great visionary. He is the Leader of Indo European Business Forum (IEBF) and also the Founder Chairman of SARC & Associates, Chartered Accountants and SARC Foundation and Life Trustee of Rashtriya Antyodaya Sangh, a Public Charitable Trust. He has over 32 years of experience in diverse fields such as Corporate planning, Financing, Taxation, Banking, Education, Investments, Oil & Gas and in project implementations. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI), Life Member of Indian Council of Arbitration and Full Member of the Institute of Certified Public Accountants of Uganda (CPA-U).

by Sunil Kumar Gupta | May 6, 2019 | blog

The concept of REIT which is an acronym for Real Estate Investment Trust has been there for nearly 60 years now REITs. REITs as an investment asset class came into being when President Eisenhower of the USA enacted a law in 1960 that enabled all investors to invest in diversified large-scale portfolios of real estate that produce income in form of rent and lease. The first REIT was launched in 1961 by American Realty Trust 1961. In 2018, globally REITs had over 2 trillion US Dollars worth of assets under management. In the budget of 2014, Finance Minister Arun Jaitley introduced a law for setting up REITs and in August 2014 India approved the creation of Real Estate investment trusts. Last month, Blackstone Group LP – Sponsored, Embassy Office Parks raised Rs 4750 cr through India’s first REIT IPO. The IPO was over-subscribed 2.58 times. Investors in this REIT IPO were allotted units at a price of Rs 300. On its listing day, the REIT IPO received a thumbs up from the market when it touched a daily high of Rs 325 and closed at Rs 314, thus enabling IPO investors to earn a sizeable gain of 4.7% on the issue price. With it India became another market having REIT offerings for individual investors.

-

Reduced Risk, Stable Returns, and Diversification for Investors in Real Estate (REIT)

A new fund-raising avenue for the cash-strapped real estate sector in the country. Firstly it gives investors an investible corpus of only a few lacs to invest instead of conventional Real Estate where you were set back by a huge amount. Secondly, it also gives investors exposure to a pool of real estate thus giving them much-needed diversification across properties and geographies. This reduces risk as end users are holders of units of securitized real estate pools. According to the guidelines, REITs will have to invest in a minimum of two projects with 60% asset value in a single project. REIT will showcase the full valuation on a yearly basis and will also update it on a half-yearly basis. Thirdly it is managed by a professional investment team so investment risk is further reduced. Last but not least is a friendly taxation structure. if a REIT unit will be by the investor for a period of more than 3 years then the long-term capital gain will be applicable. If the periodic income is through dividends then it is tax-free and if the pay-out is in the form of interest then tax will be applicable as per the tax slab of the unit holder. For Indians, Real Estate has always been a preferred investment class as according to an RBI study about 56 percent of Indian household savings have been concentrated in Real Estate but Indians have long invested largely in Residential Real Estate which has lower rentals. Retail investors have stayed away from commercial real estate because of the higher ticket size of investment and the complexity associated with commercial property ownership. Colliers Research shows that the Indian market is rife with great opportunities in terms of rental yields as evident from the infographic shown below.

The launch of the first REIT will certainly be a game changer for Real Estate as it has the potential to revive the commercial real estate segment by introducing Retail investors to contribute sizeable inflows across this segment.

-

Needed Liquidity Boost for Real Estate Industry (REIT)

The greatest benefit for the Real Estate industry as a whole will be that of fast and easy liquidation of investments in the real estate market, unlike the traditional way of disposing of real estate which is very opaque and fraught with risks of fraud, cheating, and legal disputes emanating from property records. The assets under REIT corpus are rent-bearing assets where an established name has gone through due diligence from multiple bodies including SEBI, so property records will be transparent and it will boost Real Estate industry sentiment. India’s real estate has endured a lot in recent years. Despite the high credit growth environment and factors like Demonetisation, Global Recession, and rapidly evolving GST structure, Real estate has held forth as a preferred asset class for Indians. This is a much-welcomed move and will give the real estate industry a much-needed boost. Given the prevalent situation of funding crunch, the launch of the first REIT offering in India is very well-timed for real estate developers who want to unlock much-needed capital to fund further projects or to pare down their debt. It will also greatly reduce a great deal of pressure on the NPA-saddled banking industry. It will ensure more liquidity for Banks to lend to end users and customers instead of relying on a much riskier way of lending through Loan Against Property (LAP) and Lease Renting Discounting (LRD).

About the Author

Sunil Kumar Gupta is an entrepreneur par excellence, philanthropist, and a great visionary. He is the Leader of Indo European Business Forum (IEBF) and also the Founder Chairman of SARC & Associates, Chartered Accountants, and SARC Foundation, and Life Trustee of Rashtriya Antyodaya Sangh, a Public Charitable Trust. He has over 32 years of experience in diverse fields such as Corporate planning, Financing, Taxation, Banking, Education, Investments, Oil & Gas, and project implementations. He is a Fellow Member of the Institute of Chartered Accountants of India (ICAI), a Life Member of the Indian Council of Arbitration, and a Full Member of the Institute of Certified Public Accountants of Uganda (CPA-U).

by Sunil Kumar Gupta | Mar 23, 2019 | blog

The Goods and Service Tax (GST) was successfully implemented across the nation on July 1, 2017 with a lot of fanfare. It is a buzz word in India these days spanning across trade circles, financial pundits, and investment gurus. GST is the biggest tax reform in India’s 70-year history as an independent nation. It has replaced a complex net of existing taxes, bringing uniform tax rates and rules and simplifying compliance for businesses. It is a single, unified tax which justifies the adage ‘One Nation-One Tax’ and will have a very positive impact on Indian economy.

Impact of GST on Indian Economy

GST will bring about a uniformity in process and centralised registration that will make starting a business and expanding in different states across the India much simpler.

GST will ensure that interstate movement becomes cheaper and is less time consuming, by eliminating small border taxes and resolving check post issues.

GST also introduces an optional scheme called the composition scheme, which empowers small businesses with turnover between Rs. 20 lakh to Rs. 75 lakh to pay lower taxes.

In the near future, GST will enable financial inclusion in the economy.

Broader Tax Base and decrease in “Black” transactions.

Improved compliance and revenue collections

Automation of compliance procedures to reduce errors and increase efficiency.

GST will reduce tax evasion.

Cascading effect of tax on tax will be eliminated.

It will harmonise Central and State tax administrations

Make in India will get a huge boost as both tax and logistics cost will fall and lead to higher investments for the manufacturing industry.

Salient Features of GST

Destination-Based Consump-tion Tax: GST is a destination-based tax. This implies that all SGST collected will ordinarily accrue to the State where the consumer of the goods or services sold resides.

Dual GST: A dual GST with the Centre and States simultaneously levying it on a common tax base. The GST to be levied by the Centre on intra-State supply of goods and / or services would be called the Central GST (CGST) and that to be levied by the States would be called the State GST (SGST).

Computation of GST on the basis of invoice credit method: The liability under the GST will be invoice credit method, i.e. cenvat credit will be allowed on the basis of invoice issued by the suppliers.

Payment of GST: The CGST and SGST are to be paid to the accounts of the central and states, respectively.

Input Tax Credit: Input Tax Credit available on taxes paid on all procurements (except few specified items).

Technology based Assistance: GSTN and GST Suvidha Providers (GSPs) to provide technology based assistance.

The government is trying very hard to implement GST successfully for the benefit of the common man but there are certain oversights, loopholes, or shortcomings in entire gamut of GST implementation that become a hurdle in sectoral growth, synergised policy making and financial transparency, which the Modi government has been encouraging ever since it has come to power.

Even though simplified, GST still has certain complexities entwined in it. GST has an anti-profiteering provision empowering the Central Government to constitute, or appoint, an authority to monitor prices businesses charge for goods and services in the lead up to, and following the introduction of, the GST. This provision prevents entities from making excessive profits due to the GST.

But, there are no clear methods of assessing the GST benefits for purposes of passing it to the consumers. A GST anti-profiteering authority is also yet to be formed.

While, the reason behind such anti-profiteering measures is to protect the masses, the government should ensure that the entities will pass the tax savings from the seamless input credit to its consumers. For the successful implementation of GST and to attain its objective, the rules and methodology of anti-profiteering provisions need to be clearly stated.

In India, various developmental authorities/governmental authorities have been entrusted the function of urban planning. Urban planning is one of the functions enlisted in Article 243W and Schedule XII of the Constitution of India.

These authorities while discharging the function of urban planning, lease out the land for a period of 90 years or more for various planned uses like industrial, institutional, residential, commercial and mixed use.

The leasing of land for such a substantial period of time is akin to sale as per the provisions of Transfer of Immovable Property Act. As such the payment made for acquisition of land popularly termed as Land Premium, Salami, Cost of Land, is treated as capital payment which is subject to levies such as stamp duty, etc., on transfer.

IN the service tax era, there was no tax on such transactions as it was taken as similar to sale of land. But, while framing the GST provisions, it has not been considered that these transactions have been brought under the GST net. However, exemption has been provided for the Lease Premium/ Salami/cost of land received by the developmental authorities/governmental authorities for allotment of land for industrial purposes.

There is no logic why land being allotted for purposes other than industrial purposes has been kept out of exemption list, while in current scenario, almost all lands being allotted by development / governmental Authorities are on a lease of 90 years or more

Land has always been kept out of the meaning of goods and service, but by taxing the Lease Premium/ Salami/cost of land, the basic concept of levy of GST has been missed.

Under the GST, where Central and State-level taxes have been merged and a provision has been put that any manufacturer with a turnover of Rs. 20 lakh (Others)/10 lakh (Special Category States) or more has to comply with GST norms related to excise duty, which earlier were exempt up to turnover less than Rs. 1.5 crore will serve as a dampener for many MSMEs. For an MSME, a lot of self-effort is utilised is staying in business by running business in a most cost effective way. Now, they will have to spend resources – time, money, and manpower – on fulfilling the GST obligations.

This can have negative impact on compliance for GST.

GST implementation has a high compliance cost to MSMEs. The single window tax regime intended to simplify processes under GST is facing many challenges in its interpretation and implementation. To reduce the GST compliance burden on MSMEs, the Government has to provide all GST compliance utilities on the GST portal. So that MSMEs can accomplish all the compliances without any hassle and any professional support.

In conclusion, I would like to state that GST is a welcome change for the Indian economy. It is bound to reap fruits of profit for India in the long term. However, while drafting the GST bill and categorising the items, there have been multiple oversights which will have adverse to negative impact on the common man of India, certain sectors and the economy at large. The government and the GST Council have not closed their doors for suggestions or observations. They have promised the country to revisit the rules and rates periodically till all the dust settles down. We need to be patient and let the financial experts do their work, however, if we need to share anything then we should be duty bound to bring it to their notice. I am very sure that with time GST will become the strongest backbone of the economy and will help Indian economy to walk miles into bliss.

The writer is an author, economist and philanthropist. He can be contacted at www.sunilkummargupta.com

by Sunil Kumar Gupta | Mar 23, 2019 | blog

Technology has really shaped up the mindset of professionals from all walks of life and its utilization has given a holistic understanding in order to pester the needs of working professionals. Now this revolutionary change applies to people in accounting industry as well.

We are in an era where without the use of technology, we can easily be ostracized and this cobwebbed situation especially in our working atmosphere can pull us out of business. Even if you’re an aspiring accountant or you’ve been a CPA for decades, you may not think much of your preferred accounting system. If you are dedicated in the field of accounting or currently pursuing a bachelor’s degree in accounting, then it is important that you must be up to date on the kind of technology being used in your professional workspace.

Let’s take a look at some of the most important accounting technologies that can help accountants to approach their workspace through an effective and efficient lens:

Cloud Computing

Cloud computing plays pivotal role as one of the efficient technologies within the accounting sector. According to Forbes, worldwide spending on cloud services will grow radically.

This paradigm shift for professionals following traditional accounting pattern has given them a technology that is used for storage and accessibility of data online rather than on your hard drive.

Blockchain Technology

Blockchain technology is the distribution and decentralization of database technology. It can protect encrypted data and sustain an expanding list of transaction between all parties of those transaction.

This accounting technology will assist many financial advisors in Delhi to bring a qualitative change in the financial industry.

Automated accounting

This type of technology eases human effort and does most of the job for you. Automated is an efficient tech that will make virtual controllers of automated accounting high in demand.

This lucrative technology will be able to redefine the role of an accountant and bring quantifiable results for the same.

Optical Character Recognition

Optical Character recognition is a new technology in the market that electrically converts images and handwritten texts or printed text into machine encoded text.

OCR is finding an elbow room in automated, cloud based applications. These technological trends create a powerhouse for business experts within the accounting software